Talks are all over market place that oil price is rebounding as WTI and Brent both setting an important bottom.

- WTI and Brent both has broken above 3 month high, which itself proves resilience of the bulls. WTI has now cleared an important resistance at $54/barrel, however bulls are struggling since then.

In the short term WTI crude is very much likely to move upward with $60/barrel as initial target and $65/barrel as next.

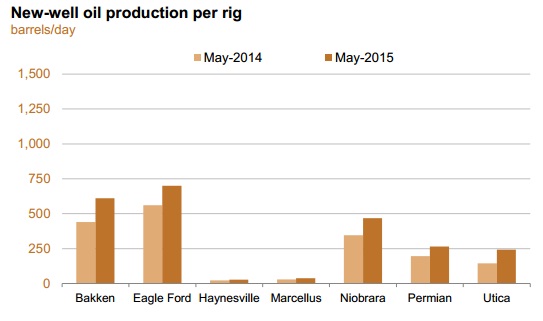

Even such a move could be premature to be calling for end to downtrend, in fact rising productivity from wells are keeping US crude production above 9 million barrels per day. With US oil farms, now focusing improving efficiency, would make them better competitor against oil form Middle East and Russia.

- As per latest estimate average crude production in US to fall only 57,000 barrels/day in May compared to more than 40% drop in producing rigs.

- Last Wednesday, EIA inventory indicated that crude oil stocks rose by another 5.3 million barrels, still beating estimates.

WTI is trading at 57.03, down -0.2% today so far.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings