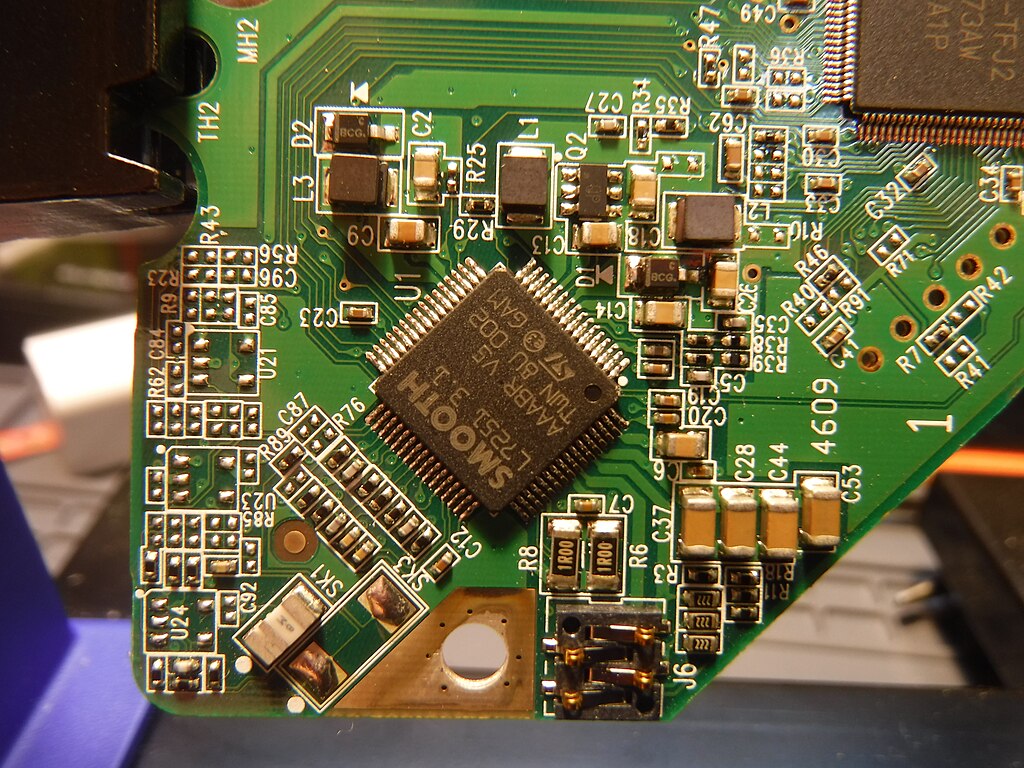

STMicroelectronics (EPA:STM) projected improved earnings for the second quarter after reporting first-quarter results that marked what the company called the low point of the year. The European chipmaker, heavily exposed to the automotive and industrial markets, has endured a prolonged sales downturn, similar to peers like NXP Semiconductors (NASDAQ:NXPI) and Siltronic.

In Q1, STMicro’s operating income plunged 99.5% year-over-year due to the continued weakness in demand, while revenues came in at $2.52 billion—matching both company guidance and analyst expectations compiled by LSEG.

Looking ahead, STMicro expects Q2 revenue to reach $2.71 billion, beating analyst forecasts of $2.62 billion. The forecast does not account for any possible impact from changing global trade tariffs.

CEO Jean-Marc Chery emphasized the company’s focus on innovation and competitiveness despite macroeconomic uncertainty. “We are concentrating on what we can control—innovating to enhance our product and technology portfolio,” Chery said.

Though the company refrained from providing full-year guidance, citing limited visibility and ongoing inventory corrections, analysts at Jefferies noted optimism for a broader cyclical recovery in the auto and industrial chip markets starting in the second half of 2025 and continuing into 2026.

However, inventories remain a concern. STMicro’s stockpile grew to 167 days’ worth of sales, up from 122 days in the previous quarter.

The sentiment echoes Texas Instruments’ (NASDAQ:TXN) recent earnings update, where it also predicted stronger Q2 revenue, signaling a potential rebound in global industrial chip demand.

As the semiconductor industry begins to emerge from a prolonged downturn, companies like STMicro and Texas Instruments are cautiously optimistic about a recovery driven by stabilizing inventories and improving industrial demand.

Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil

Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil  Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports

Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies

Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies  Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch

Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch  SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates

SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates  Nintendo Shares Slide After Earnings Miss Raises Switch 2 Margin Concerns

Nintendo Shares Slide After Earnings Miss Raises Switch 2 Margin Concerns  Instagram Outage Disrupts Thousands of U.S. Users

Instagram Outage Disrupts Thousands of U.S. Users  Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million

Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million  Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies

Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies  Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate

Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate  Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit

Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit  CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences

CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences  Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge

Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge  Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links

Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links  Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised  TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment