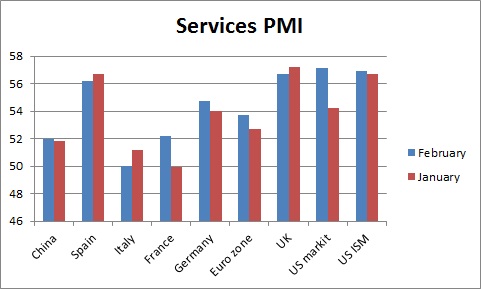

Services PMI data released today suggest despite divergence, global growth is improving as a whole.

Key highlights -

- China services continued to expand at better rate 52

- Spain come back is still robust at 56.2

- Italy services faltered and barely grew at 50

- French services grew at 52.2 after slump in January

- UK still strong at 56.7 but services is not as strong as previous year

- Markit & ISM indicated that US is growing at much faster pace. Markit at 57.1 and ISM at 56.9

Indication -

- Global growth is coming back on line that could mean higher inflation in the long run or at least wage inflation in the services sector. Wages have started going up in US, UK and Germany. In Germany it was 3.4 percent in the latest union negotiation.

- The loose monetary policy by central banks would boost the growth further in the coming months.

Market Impact -

- FED might be able to move ahead with the rate hike this year that could prompt further strengthening of treasury yields.

- Global growth would be supportive of Equity market unless the market loses grip over inflation fear which could began with turnaround in oil price.

|

Country |

February |

January |

|

China |

52 |

51.8 |

|

Spain |

56.2 |

56.7 |

|

Italy |

50 |

51.2 |

|

France |

52.2 |

49.9 |

|

Germany |

54.7 |

54 |

|

Euro zone |

53.7 |

52.7 |

|

UK |

56.7 |

57.2 |

|

US markit |

57.1 |

54.2 |

|

US ISM |

56.9 |

56.7 |

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary