Euro's volatility continues to persist as the further dipping streak in its exchange rate on the cards. While in the UK, for good reason inflation has disappointed. Staying at zero for the second month in a row, as the house prices slowed down further.

And it's not just inflation, additionally the growth in manufacturing wage has slowed, the UK election is nearing (scheduled on May 7th) a risk for higher EUR/GBP. Both these factors and inflation in addition make the BoE more meticulous about the GBP strength and its impact this year. It is expected the further deflation in the near future which is a niggling thing for the BoE.

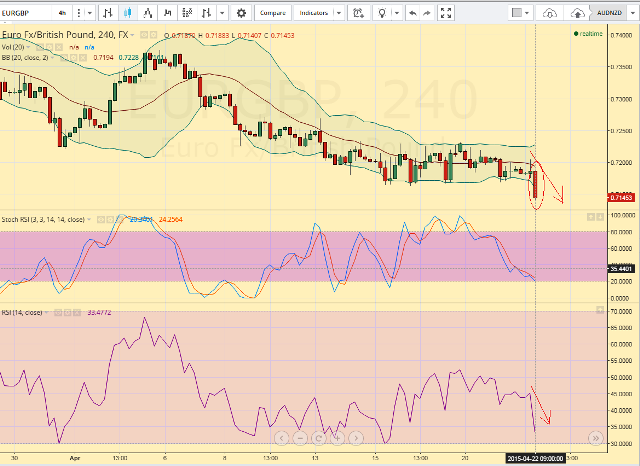

Technicals show the pair took a proper support at the 0.7150 level to twist things back around and form a hammer after falling during the day on today. From last couple trading sessions some type of impulsive candles occurred back to back.

At the moment, it just simply isn't worth risking your trading capital been involved in a market that has no interest in going anywhere. So traders can find opportunities of shorting on every rise (probably on 0.7168 levels) as it may rebound for some time to dip back again. On an hourly chart one can figure out Euro tumbling, this one could be luring for swing traders.

Shorting Euro keeps traders happy

Wednesday, April 22, 2015 12:52 PM UTC

Editor's Picks

- Market Data

Most Popular

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary