Singapore’s Export growth is likely to remain healthy, albeit slower. Headline non-oil domestic export figures for September due tomorrow is expected to register an increase of 12.3 percent y/y. This will be a moderation from 17.0 percent in the previous month but in line with our view that momentum should be gradually tapering-off towards the year-end, DBS Group Research reported.

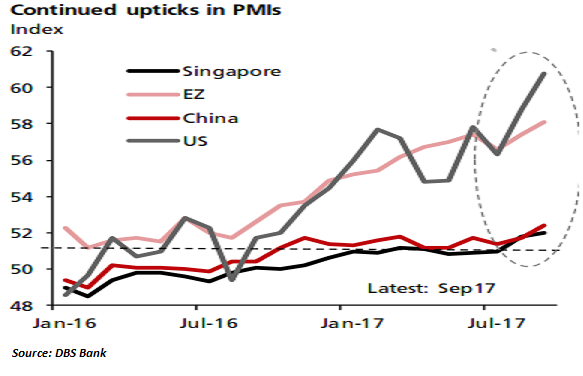

Nonetheless, this is still considered a robust expansion and continued to underscore the exuberance on the external front. The PMIs of key export markets have been strong while the rally in the electronics cluster is not abating. Hence, any sign of moderation should be seen as a shift towards a more sustainable growth path.

Going forward, China’s growth could moderate amid the process of deleveraging. Rising trade protectionism and monetary policy normalization by the US Fed and the ECB may also keep global demand in check. The Fed will likely resume its hiking cycle from December onwards while reducing its balance sheet. The ECB will likely follow suit in 2018. All these make for a softer global outlook, and henceforth, a drag on export performance in the coming months.

Meanwhile, FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out