The slowdown in industrial production (IP) and retail sales in July is likely to be temporary; we expect a rebound in the upcoming months. IP growth slowed to 6.4 percent y/y in July, weighed upon by the mining and manufacturing sectors. It is believed that a part of the slowdown stemmed from adverse weather conditions, whose effects will likely falter in the upcoming months.

Headline growth of retail sales decreased to 10.4 percent y/y in July from prior 11 percent. However, online sales remained quite vibrant, rising 28.9 percent y/y in the month, and are likely to continue to offset the moderation in growth among traditional retailers.

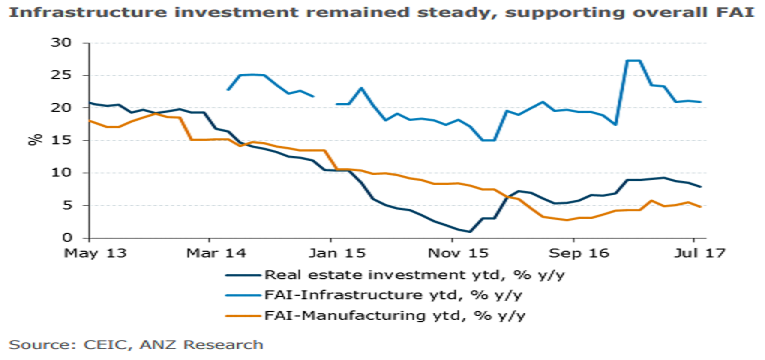

The growth of property investment eased to 7.9 percent y/y between January and July, the lowest this year. This seems to suggest that the government’s tightening policies have finally trickled down through the economy. However, land sales income for local provincial governments continued to surge 37.3 percent y/y in July.

"We continue to think the correction in the property market will be only moderate, even though the growth in property investment slowed further in July," ANZ Research commented in its latest report.

Meanwhile, FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm