Quotes from Societe Generale

- Today's ECB meeting in Cyprus should be accompanied by a few more details about the bond-buying programme, but few fireworks.

- Re-affirmation of the commitment to buy EUR 60bn per month, some clarity on the logistics will be important to the bond market, which has gone a long way since the original announcement. Any sign of discord would be noteworthy too.

- But while the risk of a further correction in Bunds is obvious, the FX market seems pretty single-minded where it comes to the Euro. The only way is (or has been, until now) down.

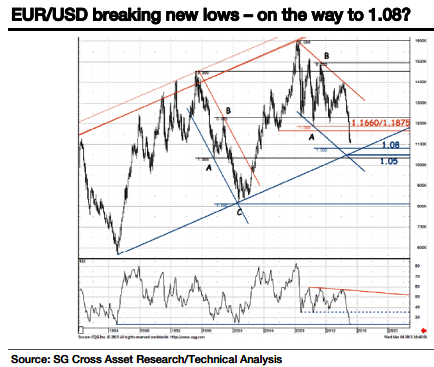

- Our technical analysts see the next support at 1.08 in EUR/USD and the lack of any kind of meaningful bounce at any stage this year probably means there are now people selling into weakness.

- Overshoot on the downside is likely if tomorrow's US payroll data are strong. All of this at a time when the European economic data show signs of improvement, albeit modest.

- You could hardly invent a better backdrop for equity markets, even if that is counter-balanced by the continued correction to risk assets globally.

- For now, the Euro goes on falling, both against the dollar and against higher-beta European currencies.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed