South Korea has expanded its support package for the semiconductor industry to 33 trillion won ($23.25 billion), marking a 27% increase from the 26 trillion won initiative announced in 2023. The move comes as global chip competition intensifies and policy uncertainties grow under the current U.S. administration.

A joint statement from multiple ministries, including the Ministry of Trade, highlighted that financial assistance for the chip sector will now reach 20 trillion won, up from the previous 17 trillion won. The goal is to help domestic chipmakers manage rising costs and enhance competitiveness in a global market increasingly dominated by Chinese rivals.

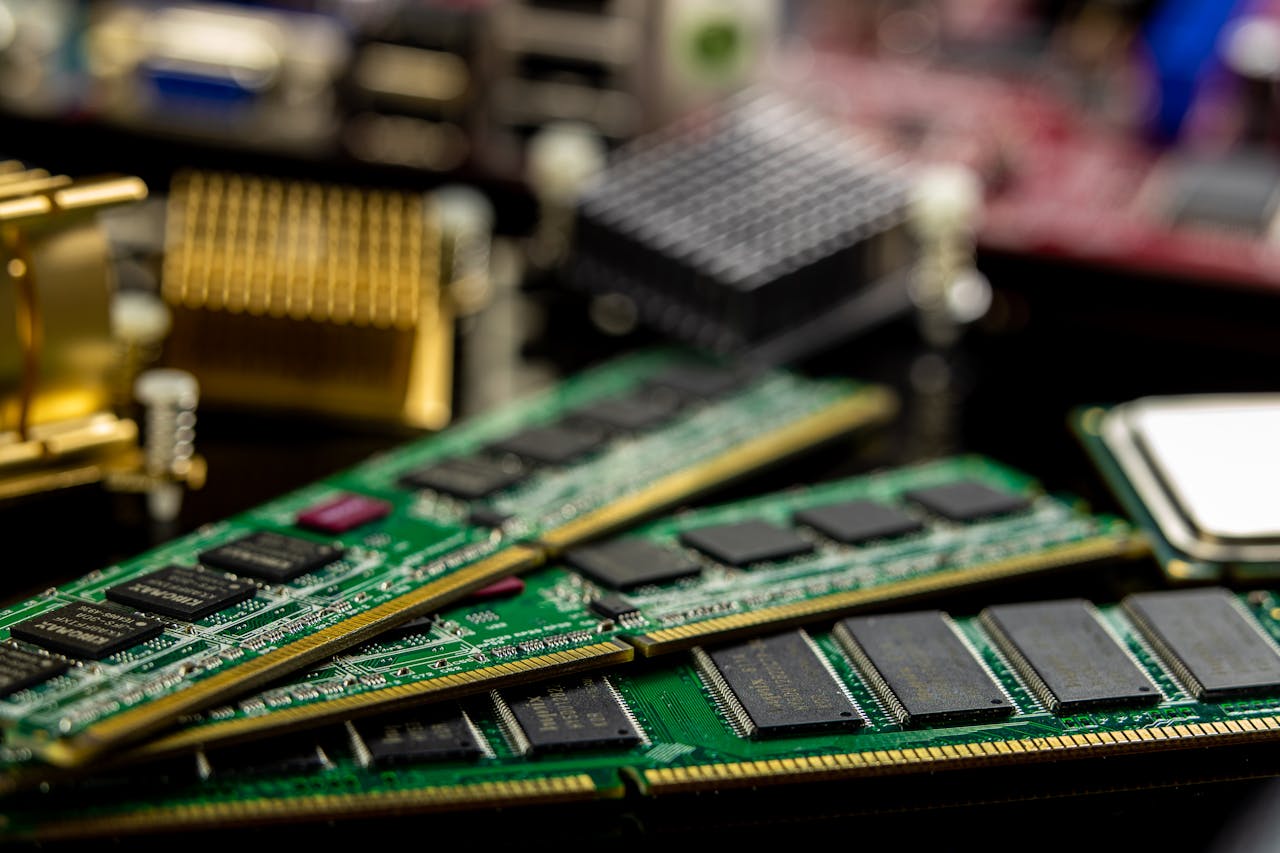

As the world’s fourth-largest economy, South Korea remains a dominant player in memory chips, led by giants Samsung Electronics and SK Hynix. However, the country is facing challenges in areas like chip design and contract manufacturing. In 2024, semiconductor exports reached $141.9 billion—21% of South Korea’s total exports—with $46.6 billion shipped to China and $10.7 billion to the U.S.

U.S. President Donald Trump recently announced plans to unveil new tariff rates on imported semiconductors, with some flexibility for certain companies. In response, South Korea’s Finance Minister Choi Sang-mok emphasized plans to engage in dialogue with U.S. officials over the Section 232 investigations into semiconductors and biopharmaceutical imports to mitigate negative effects on Korean firms.

Last week, Seoul also introduced emergency support for its auto industry, including tax cuts, subsidies, and financial assistance, aiming to cushion the impact of potential U.S. tariffs. The government reiterated its commitment to negotiating with Washington and diversifying export markets to safeguard its key industries.

This strategic funding boost underscores South Korea's resolve to remain a global leader in semiconductors amid shifting geopolitical and economic landscapes.

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  U.S. Lawmakers to Review Unredacted Jeffrey Epstein DOJ Files Starting Monday

U.S. Lawmakers to Review Unredacted Jeffrey Epstein DOJ Files Starting Monday  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Japan Election 2026: Sanae Takaichi Poised for Landslide Win Despite Record Snowfall

Japan Election 2026: Sanae Takaichi Poised for Landslide Win Despite Record Snowfall  TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans

TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans  Trump Signs “America First Arms Transfer Strategy” to Prioritize U.S. Weapons Sales

Trump Signs “America First Arms Transfer Strategy” to Prioritize U.S. Weapons Sales  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  China Warns US Arms Sales to Taiwan Could Disrupt Trump’s Planned Visit

China Warns US Arms Sales to Taiwan Could Disrupt Trump’s Planned Visit  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Netanyahu to Meet Trump in Washington as Iran Nuclear Talks Intensify

Netanyahu to Meet Trump in Washington as Iran Nuclear Talks Intensify  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Iran–U.S. Nuclear Talks in Oman Face Major Hurdles Amid Rising Regional Tensions

Iran–U.S. Nuclear Talks in Oman Face Major Hurdles Amid Rising Regional Tensions  U.S. Announces Additional $6 Million in Humanitarian Aid to Cuba Amid Oil Sanctions and Fuel Shortages

U.S. Announces Additional $6 Million in Humanitarian Aid to Cuba Amid Oil Sanctions and Fuel Shortages  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal