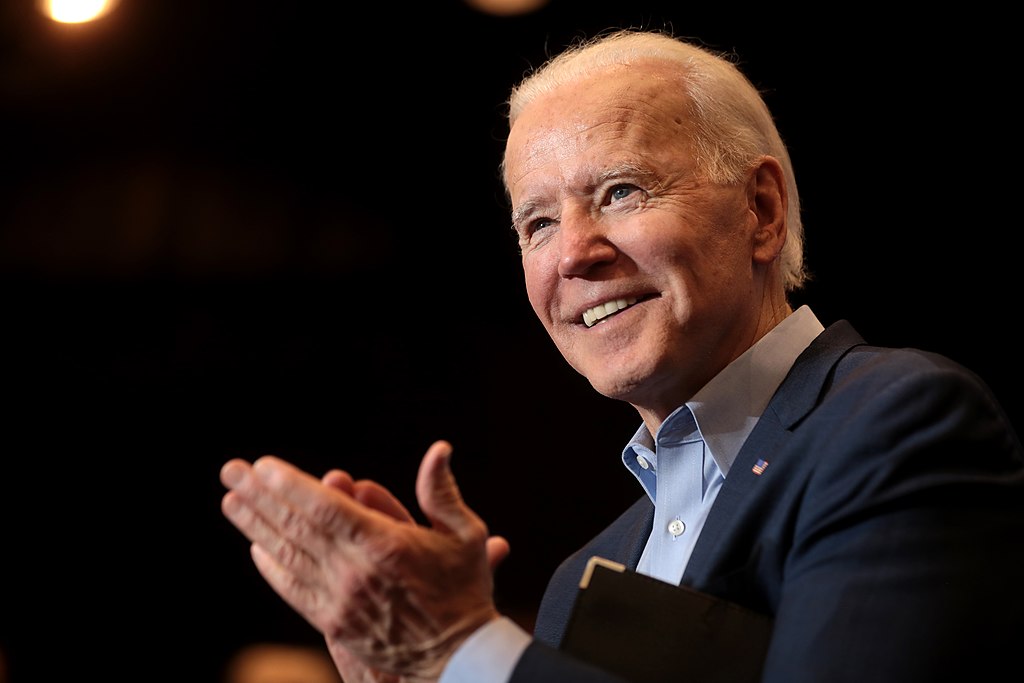

Today, the stock market experienced a dramatic crash as President Joe Biden convened in the White House Situation Room to address escalating tensions with Iran. The sudden financial downturn has sent shockwaves through the economy, raising concerns about the market's stability and the broader implications of a potential conflict with Iran.

As investors grapple with significant losses, the Biden administration is under immense pressure to manage the geopolitical crisis while stabilizing the economy. The president's focus on the threat of war with Iran underscores the gravity of the situation, with many Americans worried about the potential for a nuclear confrontation and its far-reaching consequences.

Today's market crash has reignited debates about the U.S. financial system's preparedness to withstand global crises. Many investors are questioning their financial security and the resilience of their portfolios in the face of such turmoil. The uncertainty surrounding the situation has prompted financial advisors to recommend diversifying assets, emphasizing the stability and long-term value of gold.

Historically, gold has been viewed as a safe-haven asset, particularly during geopolitical uncertainty and economic instability. As traditional markets fluctuate, gold often retains its value, offering a buffer against the volatility in stocks and other investments. This renewed interest in gold comes as investors seek to protect their wealth and ensure they have the resources to navigate potential crises.

The crisis with Iran has been building over recent months, with tensions escalating following a series of provocative actions and threats. The possibility of Iran developing or deploying nuclear weapons has heightened fears, leading to a tense standoff that now demands urgent diplomatic and strategic responses. President Biden's administration is tasked with finding a resolution that avoids conflict while safeguarding national and global security.

Financial markets are highly sensitive to geopolitical developments, and the specter of war with Iran has rattled investor confidence. The ripple effects of today's crash are likely to be felt across various sectors, with analysts predicting further volatility in the coming days. The Biden administration's handling of the crisis will be closely scrutinized as political and economic stability hangs in the balance.

For many Americans, the question is how to protect their financial futures in uncertain times. The surge in interest in gold investment reflects a broader desire for security and stability. As the situation with Iran continues to unfold, individuals and institutions are reassessing their investment strategies to mitigate risk and ensure long-term resilience.

In the face of these challenges, financial experts emphasize the importance of staying informed and making strategic decisions to safeguard assets. Diversification, including investments in precious metals like gold, is being touted as a prudent approach to weathering the storm.

As the Biden administration works to address the threat posed by Iran, the focus remains on resolving the geopolitical crisis and stabilizing the economy. The coming days will be critical in determining the market's direction and international relations. Investors and citizens alike are urged to stay vigilant and prepared for developments.

Philippines, U.S., and Japan Conduct Joint Naval Drills in South China Sea to Boost Maritime Security

Philippines, U.S., and Japan Conduct Joint Naval Drills in South China Sea to Boost Maritime Security  Strait of Hormuz Oil and LNG Shipments Disrupted After U.S.-Israel Strikes on Iran

Strait of Hormuz Oil and LNG Shipments Disrupted After U.S.-Israel Strikes on Iran  Trump Launches Operation Epic Fury: U.S. Strikes on Iran Mark High-Risk Shift in Middle East

Trump Launches Operation Epic Fury: U.S. Strikes on Iran Mark High-Risk Shift in Middle East  OpenAI Hires Former Meta and Apple AI Leader Ruomin Pang Amid Intensifying AI Talent War

OpenAI Hires Former Meta and Apple AI Leader Ruomin Pang Amid Intensifying AI Talent War  Bank of Korea Holds Interest Rate at 2.50% as Growth Outlook Improves Amid AI Chip Boom

Bank of Korea Holds Interest Rate at 2.50% as Growth Outlook Improves Amid AI Chip Boom  Lynas Rare Earths Shares Surge on Strong Half-Year Earnings and Rising Global Demand

Lynas Rare Earths Shares Surge on Strong Half-Year Earnings and Rising Global Demand  Argentina Senate Approves Bill to Lower Age of Criminal Responsibility to 14

Argentina Senate Approves Bill to Lower Age of Criminal Responsibility to 14  Greg Abel’s First Berkshire Hathaway Shareholder Letter Signals Continuity, Caution, and Capital Discipline

Greg Abel’s First Berkshire Hathaway Shareholder Letter Signals Continuity, Caution, and Capital Discipline  FAA Plans Flight Reductions at Chicago O’Hare as Airlines Ramp Up Summer Schedules

FAA Plans Flight Reductions at Chicago O’Hare as Airlines Ramp Up Summer Schedules  MOEX Russia Index Hits 3-Month High as Energy Stocks Lead Gains

MOEX Russia Index Hits 3-Month High as Energy Stocks Lead Gains  Meta Signs Multi-Billion Dollar AI Chip Deal With Google to Power Next-Gen AI Models

Meta Signs Multi-Billion Dollar AI Chip Deal With Google to Power Next-Gen AI Models  U.S.-Israel Strike on Iran Escalates Middle East Conflict, Trump Claims Khamenei Killed

U.S.-Israel Strike on Iran Escalates Middle East Conflict, Trump Claims Khamenei Killed  Panama Investigates CK Hutchison’s Port Unit After Court Voids Canal Contracts

Panama Investigates CK Hutchison’s Port Unit After Court Voids Canal Contracts  Middle East Airspace Shutdown Disrupts Global Flights After U.S.-Israel Strikes on Iran

Middle East Airspace Shutdown Disrupts Global Flights After U.S.-Israel Strikes on Iran  Trump to Address Nation as U.S. Launches Strikes in Iran, Axios Reports

Trump to Address Nation as U.S. Launches Strikes in Iran, Axios Reports  Stock Market Movers: Dell, Block, Duolingo, Zscaler, CoreWeave, Autodesk, Rocket, MARA

Stock Market Movers: Dell, Block, Duolingo, Zscaler, CoreWeave, Autodesk, Rocket, MARA  Macron Urges Emergency UN Security Council Meeting as US-Israel Strikes on Iran Escalate Middle East Tensions

Macron Urges Emergency UN Security Council Meeting as US-Israel Strikes on Iran Escalate Middle East Tensions