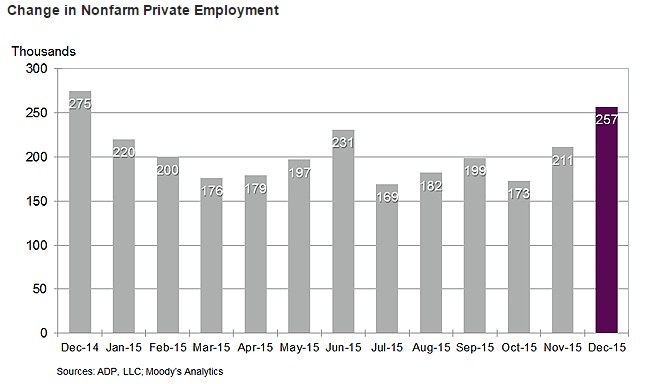

Today ADP employment numbers were released from US for the month of December.

ADP number shows US economy and its labour markets are quite robust, in spite of global economic slowdown.

There are two things to note even in the headline that,

- Job growth way beat expectations, number can be considered as superb, best since December 2014.

- November payroll marginally revised to 211,000 (down from 217,000).

Key highlights:

- Non-farm private sector employment grew at 257,000 in December, median expectation was for 192,000.

- Small business sector hiring at 95,000, compared to 81,000 last month.

- Employment in franchise increased to 48,600 compared to last month's 25,600.

- Mid-sized companies added 65,000 jobs compared to last month's 62,000 jobs.

- Large sector added just 97,000 compared to last month's 74,000 jobs.

- Manufacturing sector payroll gained by 2,000 compared to 6,000 job gains last month.

- 23,000 jobs were added in goods producing sector, compared to last month's 13,000

- Construction sector added 24,000 on payroll, compared to last month's 16,000.

- Services sector employment remains robust as payroll added 234,000 people in December. November gains were 204,000.

Dollar is however only marginally higher however scope of any large gains remain limited, with NFP report to be released on Friday.

FXCM US Dollar index is currently trading at 12200.

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  China Holds Loan Prime Rates Steady in January as Market Expectations Align

China Holds Loan Prime Rates Steady in January as Market Expectations Align