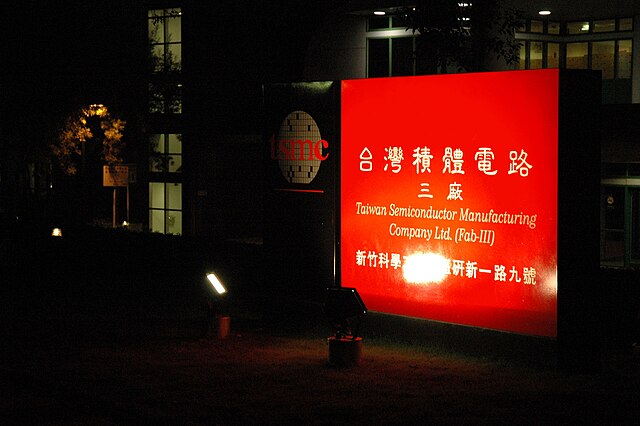

Taiwan Semiconductor Manufacturing Co. (TSMC), the leading global producer of advanced chips powering artificial intelligence (AI) applications, is expected to announce a 58% jump in fourth-quarter profit. Analysts estimate TSMC's net profit for Q4 at T$377.95 billion ($11.41 billion), up from T$238.7 billion a year earlier, driven by surging AI demand.

TSMC, whose major clients include Apple and Nvidia, has benefited from the growing adoption of AI technologies. The company recently reported a significant increase in Q4 revenue, surpassing market expectations. On Thursday, it will reveal its revenue outlook in U.S. dollars during its earnings call.

Despite its strong performance, TSMC faces challenges, including U.S. technology export restrictions on China and uncertainty over potential tariffs under the incoming Trump administration. However, Arete Research analyst Brett Simpson noted that TSMC’s investment in Arizona—a $65 billion commitment to three factories—positions it favorably as the largest foreign direct investment project in the U.S. This could strengthen its relationship with the administration.

Chairman Edward Chen of Fubon Financial highlighted the importance of progress on TSMC's Arizona fab, particularly yield rates, for the company’s future performance. Meanwhile, TSMC plans to increase its capital expenditure in 2024 to over $30 billion, with expectations of even higher spending in 2025 to meet rising AI-related demand.

Last year, TSMC’s stock soared 81%, outperforming the broader market's 28.5% gain. The AI-driven boom continues to elevate Asia's most valuable company as it races to expand production capabilities.

Kraken's Jesse Powell Criticizes SEC Over Legal Action

Kraken's Jesse Powell Criticizes SEC Over Legal Action  Anthropic Refuses Pentagon Request to Remove AI Safeguards Amid Defense Contract Dispute

Anthropic Refuses Pentagon Request to Remove AI Safeguards Amid Defense Contract Dispute  Standard Chartered’s Investment Arm, SBI Holdings to Set Up Digital Asset Joint Venture in the UAE

Standard Chartered’s Investment Arm, SBI Holdings to Set Up Digital Asset Joint Venture in the UAE  Mastercard's Shopping Muse: A New Era in AI-Driven E-commerce Personalization

Mastercard's Shopping Muse: A New Era in AI-Driven E-commerce Personalization  Trump Orders Federal Agencies to Halt Use of Anthropic AI Technology

Trump Orders Federal Agencies to Halt Use of Anthropic AI Technology  Coupang Faces Fallout from Data Breach and Rising Competition in South Korea’s E-Commerce Market

Coupang Faces Fallout from Data Breach and Rising Competition in South Korea’s E-Commerce Market  Mastercard Partners with MoonPay to Unlock Web3 Capabilities in Experiential Marketing

Mastercard Partners with MoonPay to Unlock Web3 Capabilities in Experiential Marketing  FCC Approves Charter Communications’ $34.5 Billion Acquisition of Cox Communications

FCC Approves Charter Communications’ $34.5 Billion Acquisition of Cox Communications  Panama Investigates CK Hutchison’s Port Unit After Court Voids Canal Contracts

Panama Investigates CK Hutchison’s Port Unit After Court Voids Canal Contracts  Visa Expands Digital Wallet Capabilities with Visa Commercial Pay

Visa Expands Digital Wallet Capabilities with Visa Commercial Pay  PayPal Shares Climb 7% Amid Strong Profit Forecast, SEC Scrutiny

PayPal Shares Climb 7% Amid Strong Profit Forecast, SEC Scrutiny  Nintendo Share Sale: MUFG and Bank of Kyoto to Sell Stakes in Strategic Unwinding

Nintendo Share Sale: MUFG and Bank of Kyoto to Sell Stakes in Strategic Unwinding  FAA Plans Flight Reductions at Chicago O’Hare as Airlines Ramp Up Summer Schedules

FAA Plans Flight Reductions at Chicago O’Hare as Airlines Ramp Up Summer Schedules  Chime Forecasts Strong 2026 Revenue Growth, Shares Jump on Profit Outlook

Chime Forecasts Strong 2026 Revenue Growth, Shares Jump on Profit Outlook  Meta Signs Multi-Billion Dollar AI Chip Deal With Google to Power Next-Gen AI Models

Meta Signs Multi-Billion Dollar AI Chip Deal With Google to Power Next-Gen AI Models  BlueScope Steel Shares Drop After Rejecting Revised A$15 Billion Takeover Bid

BlueScope Steel Shares Drop After Rejecting Revised A$15 Billion Takeover Bid  Amazon’s $50B OpenAI Investment Tied to AGI Milestone and IPO Plans

Amazon’s $50B OpenAI Investment Tied to AGI Milestone and IPO Plans