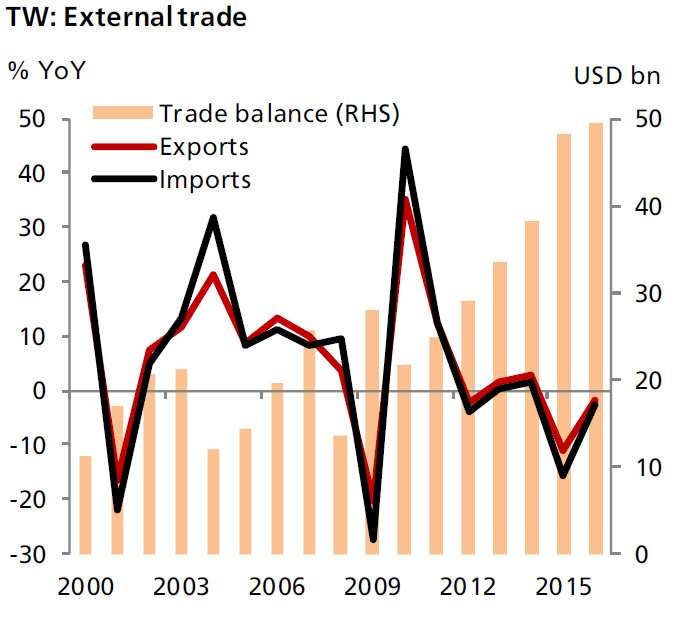

Taiwan trade surplus rose unexpectedly in December, rising to a seasonally adjusted annual rate of TWD 4.86 billion, from TWD 4.27 billion in November. Also, markets had expected trade balance to fall to TWD 4.20 billion.

Moreover, the country’s export maintained the double-digit rate of growth in December for the second consecutive month and quickened further to 14.0 percent y/y from previous 12.1 percent. On the other hand, import growth also bounced back to 13.2 percent from 3.0 percent in the meantime, with capital goods imports surging especially strongly by 34.1 percent.

It is worth noting that this data confirms that the Taiwan’s economic recovery is on the track, thanks to global rising inflation expectations and recovering economic growth. Also, recover in energy prices at the end of 2016 supported the cause.

But it is premature to anticipate a strong/smooth recovery ahead, given that global trade protectionism and China’s deleveraging/economic rebalancing remain the potential concerns, noted DBS Group Research.

In the full year of 2016, exports fell -1.7 percent, the second consecutive year of contraction. Looking ahead, chances are high that the annual growth in exports and imports will both turn positive this year. We currently look for 7.1 percent growth in exports and 9.9 percent in imports during 2017, which will generate USD 46 billion surpluses in the external trade balance, they added.

Lastly, we foresee that the annual GDP growth will not find any hurdle to reach 2 percent in 2017. Also, the pressure of capital outflows stemming from faster Fed hikes this year should be mainly reflected in the TWD/USD bilateral rate. On the relative basis, there are reasons to expect the TWD to stay resilient in 2017.

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns