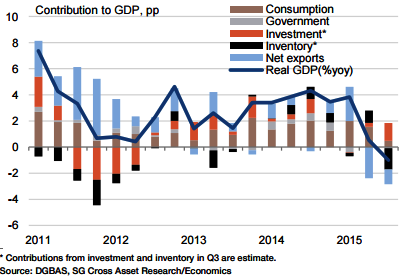

Taiwan's domestic demand softened sharply in Q3. Private consumption growth fell to 0.9% yoy in Q3 from 2.9% yoy in the previous quarter, partly due to a negative base effect. Gross capital formation (investment + inventories) growth swung from 5.5% yoy in Q2 to - 1.3% yoy in Q3.

That said, strong imports of capital goods in Q3 indicate a pick-up in investment. The weakness in gross capital formation likely came from destocking. Again, a strong negative base effect is likely to have amplified the negative impact of destocking.

"Without further details in the flash GDP report, the volatile swing in inventories is expected to have shaved at least 2pp off headline GDP growth. Meanwhile, external trade continued to decelerate. Real exports declined at a stronger rate of 2.9% yoy in Q3 after the drop of 1.3% yoy in Q2", says Societe Generale.

Real import growth turned negative to -1.5% yoy in Q3 from +2.2% yoy in Q2. However, since imports declined faster than exports, the negative contribution from net exports actually narrowed and raised GDP growth by 1.3pp.

Overall, the weakness in Taiwan's Q3 GDP growth has been exaggerated by strong negative base effects. In fact, in seasonally adjusted qoq terms, GDP recovered from a big drop of 1.68% to 0.05%

Taiwan's domestic economy wobbles

Friday, October 30, 2015 10:19 AM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX