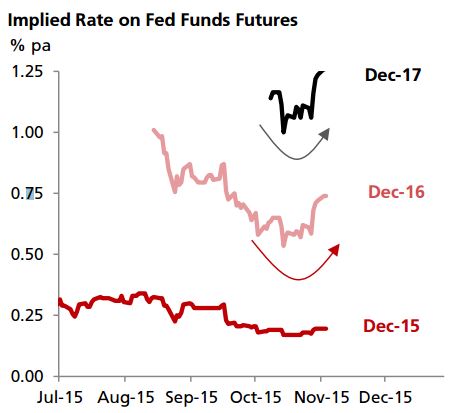

Over the past two weeks, market expectations of Fed normalization have rebounded somewhat. Much of this has got to do with the market interpreting the October FOMC outcome to be more hawkish than anticipated. Sensitivity to changing expectations is more apparent for end-2016 and end-2017 as compared to the end-2015. Notably, the implied Fed funds rate for end-2015 barely bounced by 3bps from the low in October to 0.2%. Comparatively, the adjustments for end-2016 and end-2017 were larger at 20bps and 26bps respectively.

While these implied rates are still well down from levels seen in mid-September, the market seems to be warming up to the possibility of Fed normalization over the medium term even if liftoff does not take place this year. Meanwhile, longer-term USD rates also rose amid an improvement in risk sentiment. Part of this has also got to do with an increase in oil prices over the past week.

On balance, we think USD rates are biased higher over the medium term as Fed normalization occurs. However, we remain cognizant that this is a binary affair. Global growth risks lurk with market rates still pricing in a fair chance of stagnation.

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action