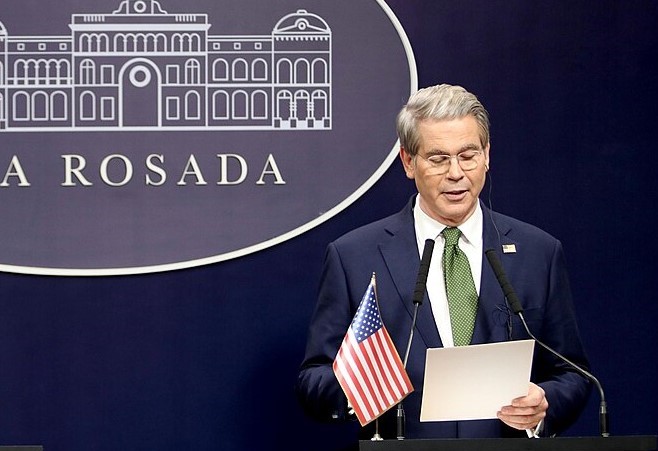

U.S. Treasury Secretary Scott Bessent has urged Congress to raise the federal debt ceiling by mid-July to prevent a potential default that could disrupt global financial markets. In a letter to lawmakers on Friday, Bessent stressed the urgency, warning there's a "reasonable probability" the U.S. government could run out of cash by August if no action is taken.

The current U.S. national debt has surpassed $36.2 trillion, exceeding the $36.1 trillion cap set by Congress in January. The Treasury Department has been deploying temporary emergency measures to meet its financial obligations, but Bessent cautioned that these stopgaps won’t last much longer.

Bessent emphasized that failing to raise or suspend the debt ceiling would seriously harm the U.S. financial system and weaken the country’s global standing. A debt default could trigger widespread market volatility and damage investor confidence in U.S. Treasury securities, often regarded as the world’s safest assets.

Republican leaders in both the House and Senate are pushing a legislative package that includes tax cuts, increased spending, and a provision to raise the debt limit by at least $4 trillion. They aim to pass the bill before the July 4 holiday.

Historically, debt ceiling negotiations have gone down to the wire, often unsettling markets and prompting credit rating agencies to downgrade U.S. government bonds. With the clock ticking, pressure is mounting on Congress to act swiftly to safeguard economic stability.

Financial analysts warn that prolonged gridlock could increase borrowing costs and hinder economic growth. As the debate intensifies, investors and global markets are closely monitoring Capitol Hill for signs of a resolution to avert a fiscal crisis.

U.S. to Begin Paying UN Dues as Financial Crisis Spurs Push for Reforms

U.S. to Begin Paying UN Dues as Financial Crisis Spurs Push for Reforms  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Norway Opens Corruption Probe Into Former PM and Nobel Committee Chair Thorbjoern Jagland Over Epstein Links

Norway Opens Corruption Probe Into Former PM and Nobel Committee Chair Thorbjoern Jagland Over Epstein Links  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Trump Allegedly Sought Airport, Penn Station Renaming in Exchange for Hudson River Tunnel Funding

Trump Allegedly Sought Airport, Penn Station Renaming in Exchange for Hudson River Tunnel Funding  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies

Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Asian Markets Slip as AI Spending Fears Shake Tech, Wall Street Futures Rebound

Asian Markets Slip as AI Spending Fears Shake Tech, Wall Street Futures Rebound  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Trump Says “Very Good Talks” Underway on Russia-Ukraine War as Peace Efforts Continue

Trump Says “Very Good Talks” Underway on Russia-Ukraine War as Peace Efforts Continue  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January