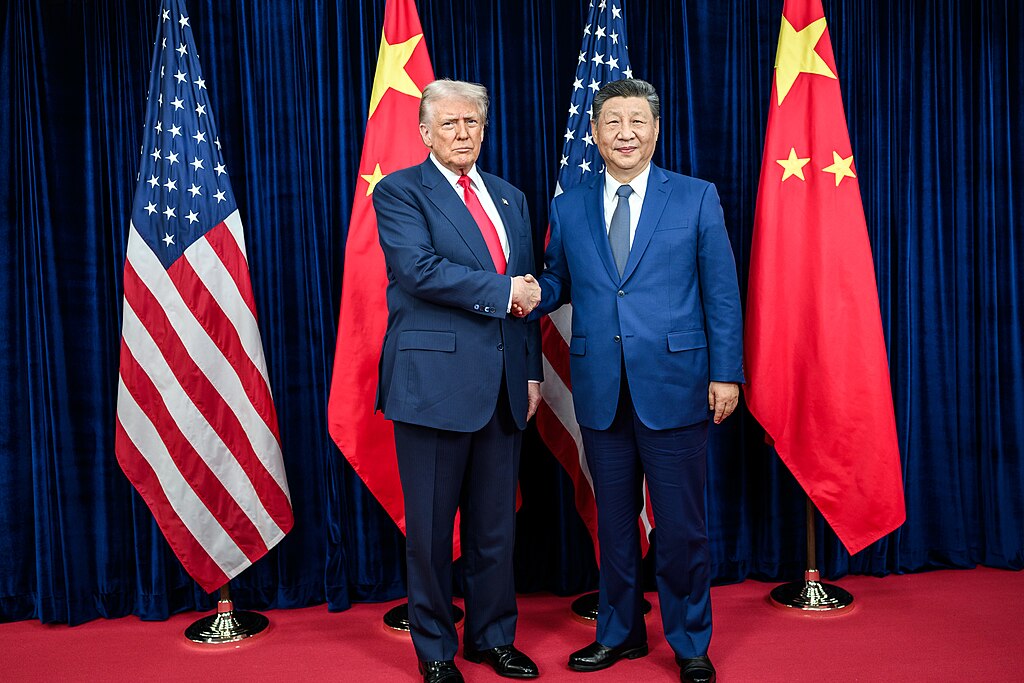

The White House has released details of a new trade agreement between U.S. President Donald Trump and Chinese President Xi Jinping, marking a major step toward easing the ongoing U.S.-China trade war. The deal, finalized in Busan, South Korea, includes tariff reductions, the suspension of Chinese export controls on rare earth minerals, and renewed agricultural purchases, extending a fragile trade truce for about a year.

Under the agreement, the U.S. will halve its 20% tariff on Chinese goods related to fentanyl precursor chemicals, lowering it to 10%. This move reduces the overall tariff rate on Chinese imports to approximately 47% from 57%. In exchange, China will pause its newly announced restrictions on exports of rare earth minerals, gallium, germanium, antimony, and graphite—critical materials for industries like defense, automotive, and technology.

Beijing will also suspend all retaliatory tariffs imposed since March, including those targeting key U.S. agricultural exports such as soybeans, corn, pork, and dairy products. Additionally, China agreed to lift non-tariff measures affecting American companies and terminate antitrust and anti-dumping investigations into U.S. semiconductor firms.

The U.S. will pause new export controls on Chinese technology companies and delay new port fees for Chinese-built and -flagged vessels for one year, helping stabilize global shipping routes.

A major component of the deal includes China’s commitment to purchase at least 12 million metric tons of U.S. soybeans by the end of 2025 and 25 million tons annually for the next three years, restoring trade flows that had been disrupted since 2024.

Both nations also pledged to cooperate on curbing the illegal fentanyl trade, with China agreeing to tighten controls on precursor chemicals. The agreement signals renewed diplomatic engagement between the world’s two largest economies and a pause in years of escalating trade tensions.

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  China Warns US Arms Sales to Taiwan Could Disrupt Trump’s Planned Visit

China Warns US Arms Sales to Taiwan Could Disrupt Trump’s Planned Visit  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Trump Signs “America First Arms Transfer Strategy” to Prioritize U.S. Weapons Sales

Trump Signs “America First Arms Transfer Strategy” to Prioritize U.S. Weapons Sales  Netanyahu to Meet Trump in Washington as Iran Nuclear Talks Intensify

Netanyahu to Meet Trump in Washington as Iran Nuclear Talks Intensify  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Jack Lang Resigns as Head of Arab World Institute Amid Epstein Controversy

Jack Lang Resigns as Head of Arab World Institute Amid Epstein Controversy  TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans

TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out