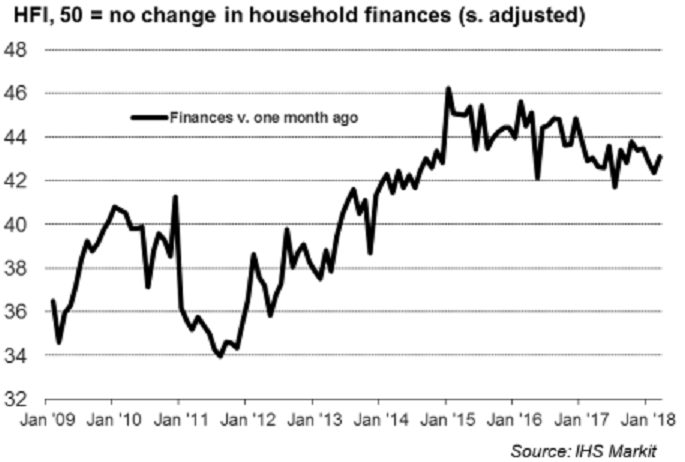

The United Kingdom’s Household Finance Index (HFI) to 43.1, up from 42.4 in February and the highest reading since December 2017. Although the figure pointed to another downturn in the country’s household finances, the degree of pressure on consumer budgets was the least marked so far in this year.

A combination of more favorable labor market conditions and a gradual easing in inflationary pressures appear to have helped to alleviate some of the strain on household finances. People aged 25-34 were the most likely to report an increase in their earnings. This provides a signal that pay rises ahead of changes to the National Living Wage threshold had helped to boost the income from employment index in March.

However, UK households remain pessimistic (on balance) about the prospects for their financial well-being over the next 12 months. At 47.6 in March, the latest index reading was below the neutral 50.0 no-threshold but broadly unchanged from the levels seen so far in 2018. Further, March data indicated positive developments in terms of pay, workplace activity, and job insecurity. At 52.3, up from 50.7 in February, the seasonally adjusted income from employment index was above the 50.0 no-change value for the fifth month running.

In addition, a clear majority of UK households are braced for higher interest rates over the coming 12 months. Just over three-quarters of survey respondents (78 percent) anticipate a rise in the Bank of England base rate by March 2019.

Meanwhile, close to 57 percent of UK households expect a rate rise within the next six months. This is little changed from 60 percent in February and well above the average figure recorded since July 2013 (34 percent).

"While higher salary payments will help offset sharply rising living costs faced by consumers, it also adds to the likelihood of additional interest rate rises in 2018," said Tim Moore, Associate Director at IHS Markit.

Lastly, FxWirePro has launched Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains