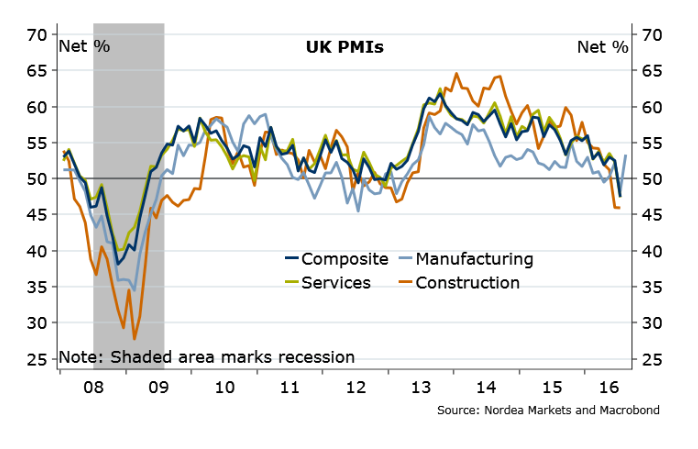

Data released earlier on Thursday showed that British manufacturing staged one of its sharpest rebounds on record in August. Markit/CIPS Purchasing Managers' Index (PMI) spiked to a 10-month high of 53.3 in August after tumbling to a three-year low in July after the referendum, which was revised to 48.3 from 48.2. The five-point monthly surge was largest rebound so far in the manufacturing survey's history. The reading beat all expectations and edged back into expansion territory (above the 50 mark).

Factories recovered from the initial Brexit shock, helped by a boost to exports from sterling's post-Brexit slump. The survey suggests manufacturing, which accounts for 10 percent of Britain's economy, is weathering the initial impact of the vote better than feared. However, whether overall activity in the economy will be sustained will largely depend on how the much bigger domestic-oriented service sector will perform.

Details showed solid rebounds in the trends in U.K. manufacturing output and incoming new orders. Export orders flowed in at their fastest rate since June 2014, though overall order growth was below June's rapid pace. Factories reported that they increased output by the highest amount since January. Employment also rose for the first time in 2016.

Data suggested that recent policy action appeared to have helped avert a downturn. Overall, the weaker GBP and the BoE’s recent policy action seem to have helped manufacturing bounce back from the post-Brexit slump and should ease concerns about the near-term outlook for the UK economy.

The flip side of the short-run boost to exports from a weaker currency are signs of rising inflation pressure. Data also underscored how the weaker currency is likely to fuel inflation. Inflation could dent progress in the sector, as the increase in input prices and output charges both hit five-year highs, due to the impact of sterling on import prices. The BoE expects higher inflation and lower living standards to be one of the main costs for households from the vote to leave the EU, outweighing gains to trade from a weaker currency.

“An increase in stock building could signal more positive hope for the coming months, but it remains to be seen whether this expansion of activity is merely filling the post-Brexit void or whether this strong performance will continue.” said David Noble, CEO at CIPS.

The British Pound surged across the board, with the GBP/JPY cross soaring through 137.00 handle to currently trade at the highest level since July 29. Cable was up 0.83 percent on the day, trading at 1.3240 at 10:45 GMT. The UK gilts plunged. The yield on the benchmark 10-year gilts rose 5 basis points to 0.692 percent, the super-long 40-year bond yield climbed 4 basis points to 1.173 percent and the yield on 5-year bond bounced more than 1 basis point to 0.228 percent by 10:40 GMT.

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock