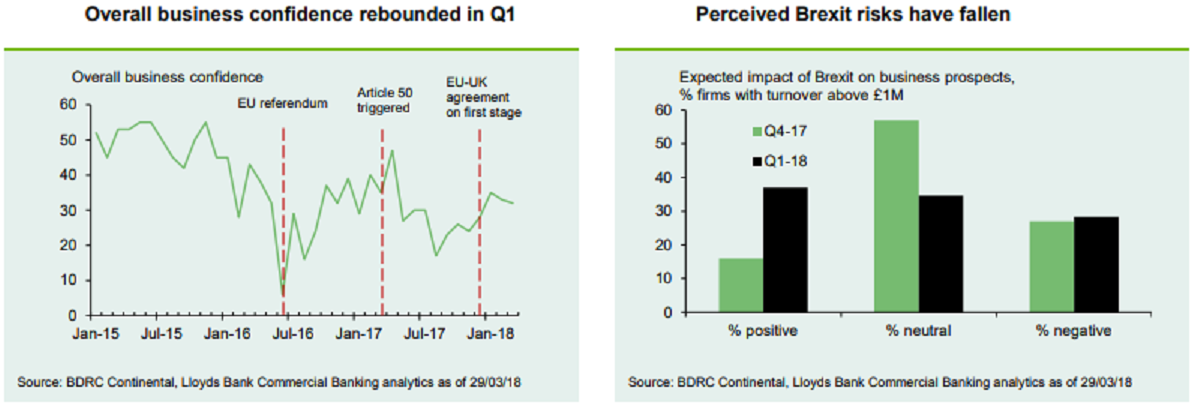

The United Kingdom’s overall business confidence – an average of firms’ own business prospects and their optimism regarding the economy – fell by 1 point in March to 32 percent. Business prospects increased by 1 point to 36 percent, while economic optimism fell by 3 points to 28 percent.

Still, for Q1 as a whole, overall confidence averaged 33 percent, compared with 26 percent in Q4 2017. The improvement over the quarter was led by the increase in economic optimism which, despite the fall in March, jumped to 30 percent in Q1 from 8 percent in the prior quarter. Business prospects, meanwhile, moved down to 37 percent in Q1 from 44 percent in Q4.

The sharp rise in economic optimism during the quarter coincided with evidence from the survey that companies were less concerned (or more positive) about the impact of Brexit for their business activity following the December agreement on the first round of negotiations.

In Q1, 37 percent of companies with a turnover above GBP1 million said that the UK’s decision to leave the EU was having a positive impact on their expectations for activity. That was a 21-point rise from 16 percent in Q4.

The share of firms reporting that Brexit was having a negative effect was almost unchanged at 28 percent in Q1, compared with 27 percent in Q4. This month’s responses were taken before the post-Brexit transitional deal was announced.

Lastly, FxWirePro has launched Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Asian Markets Slip as AI Spending Fears Shake Tech, Wall Street Futures Rebound

Asian Markets Slip as AI Spending Fears Shake Tech, Wall Street Futures Rebound  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Oil Prices Slip as U.S.–Iran Talks Ease Supply Disruption Fears

Oil Prices Slip as U.S.–Iran Talks Ease Supply Disruption Fears  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals