Today inflation reading will be published from UK at 9:30 GMT. Data set includes Consumer Price index (CPI), producer price index (PPI), and retail price index (RPI) and house price index (HPI).

- Inflation readings will be closely monitored by both markets and officials at Bank of England (BOE) as it remains key concern of Bank of England (BOE), before it considers raising rates.

- However, Bank of England (BOE) Governor Mark Carney and other officials have clearly indicated that inflation might stay low in the near term, due to lower energy prices. Latest inflation report shows, inflation may remain well below BOE target of 2% in 2016, and may not even move much even if rates remain at same level.

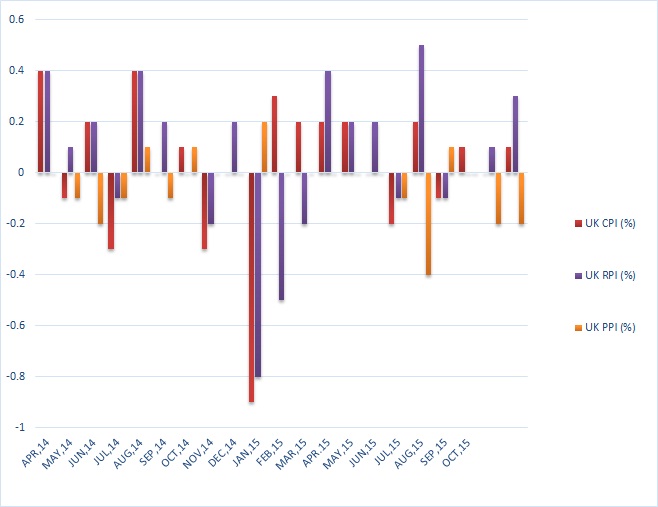

Past trends -

- CPI has been hovering close to zero percent for months now. In January last year reading was deep in negative territory, fell by -0.9% m/m, and bounced back since in February and March. Yearly growth in CPI has been negative for first time in April in at least 50 years and remained close to zero since. CPI was 0.1% y/y in December.

- PPI is broadly under downside pressure due lower input costs thanks to lower commodity prices. PPI was -1.2% y/y in December.

- RPI last year mostly remained in positive territory however in later half of the year and especially February saw sharp decline. RPI after moving to positive territory since March last year, dipped into negative in July but jumped up to 0.5% in August, only to become subdued again. In December RPI came at 1.2% y/y.

Expectation today -

- CPI is expected to drop by -0.7% m/m and grow 0.3% m/m.

- PPI is expected to drop by -0.9% on yearly basis.

- RPI is expected to drop by -0.6% m/m and 1.4% y/y.

- House prices are also expected to move up in January by 7.9% from a year ago.

Market impact -

- Due to lower oil price, it is well expected that inflation would be subdued, so Pound has limited scope to fall on data but can jump up on positive surprise.

- Focus is on EU summit this week on Thursday and Friday.

Pound is currently trading at 1.444 against dollar.