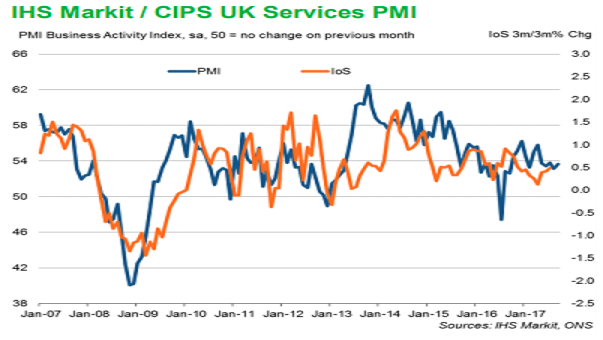

Business activity across the UK service sector continued to remain upbeat although the rate of expansion edged up only slightly since August and remained weaker than seen on average in the first half of the year. Relatively subdued domestic demand acted as a drag on activity growth, with the latest rise in incoming new work the slowest for 13 months.

The headline seasonally adjusted IHS Markit/CIPS Services PMI Business Activity Index posted 53.6 in September, up from an 11-month low of 53.2 in August. Looking at Q3 as a whole, growth has eased slightly since the previous quarter (the index averaged 54.3 in Q2, compared to 53.5 in Q3).

Service providers commented on subdued business-to-business sales and delayed decision making on large projects in response to Brexit-related uncertainty. Reflecting this, latest data indicated that overall new business volumes expanded at the slowest pace since August 2016.

Despite the softer new business growth and fragile business confidence, latest data indicated a sustained rise in service sector employment. The rate of job creation eased only slightly from August’s 19-month high. Moreover, a number of firms commented on increased unfilled vacancies at their business units, reflecting difficulties in recruiting suitably skilled staff.

September data indicated that input cost inflation reached a seven-month high and remained among the strongest seen since early-2011. Higher operating expenses were linked to rising food, energy and fuel bills, alongside increased prices for imported items and greater staff salaries.

"Whether there will be any significant bounce-back towards the end of the year remains unlikely if the political landscape remains ambiguous and cost pressures continue to bear down on the sector," said Chris Williamson, Chief Business Economist at IHS Markit.

Meanwhile, FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility