U.S. retail sales statistics for the month of April will be released at 12:30 GMT, today.

Why retail sales and U.S. consumers are important?

- Domestic consumption of goods contributes about 25% of GDP or around $ 4.5 trillion. Among these durable goods such as vehicles, furniture account for only $1.5 trillion. Buying of non-durables such as food, clothing account for $3 trillion.

- Moreover, services, which is not covered by retail sales account for 45% of the GDP and mainly consumed at home.

Past trends –

- Retail sales, as well as personal consumption expenditure, have been growing in last few years. Fed has repeatedly said that personal income growth remains robust. However, expenditure has remained weak compared to income. For inflation to remain upbeat continued expansion in domestic consumption is of utmost importance.

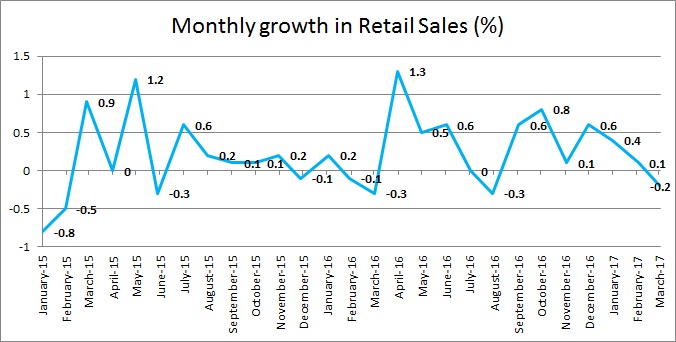

- Except for growing 0.9% in March, 1.2% in May and 0.6% in July, retail sales have remained subdued throughout 2015. In four months in 2015 growth has been negative.

- Even in 2016, the numbers were very weak. February and March were negative. However, it has somewhat bounced back since April, when it grew by 1.3 percent, followed by 0.5 percent in May and 0.6 percent in June. But in July, retail sales didn’t grow at all and excluding autos it was down by 0.3 percent. In September it grew by 0.6 percent but declined by 0.3 percent in August. Retail sales growth was robust in October growing 0.8 percent excluding autos. It ended the year with 0.2 percent growth. Look at the chart above for greater clarity.

- In January this year, retail sales grew by 0.4 percent. Since December last year, growth has steadily weakened. And last month, it was negative.

Expectations today –

- Today it is expected to grow by 0.6 including autos and by 0.3 percent excluding autos.

Impact –

- Since the Retail sales report release is coinciding with the release of the inflation report, without a major decline or growth the report could become a non-event phenomenon.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed