Today second estimate of US first quarter GDP will be released at 12:30 GMT.

Market is expecting bad first quarter for US economy.

Past trends -

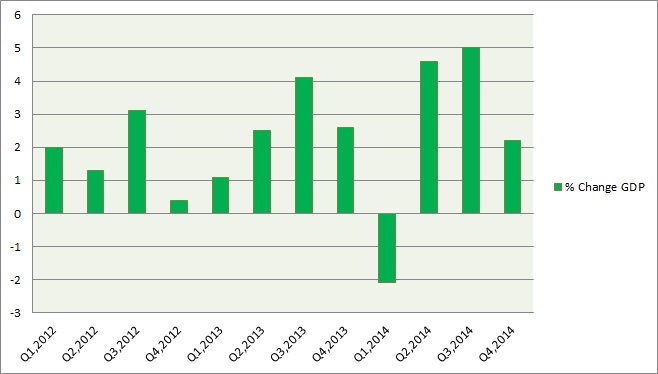

- US has so far been on solid growth path, rising 5% and 2.2% in previous two quarters. Annual growth rate in GDP stands above 2%. Historically speaking US GDP usually falters in the first quarter.

Expectation today -

- Market is expecting a number around -0.8% shrinkage on quarterly basis, as surveyed by Bloomberg. GDP estimate has higher probability to surprise to downside than upside today.

Market impact -

- Dollar and yields will strengthen sharply, should the data surprise on the upside. Stronger than expected number would be very bullish since market is expecting pretty negative numbers. Nevertheless, if data comes in line with expectation it will still be price supportive of dollar as well as yields.

- Weaker data might push the dollar on bearish side, however extreme bearishness is unlikely since FED officials have raised possibilities of first quarter shrinkage of as high as 1%.

Dollar index is currently trading at 96.92, up 0.05% today so far. Yen and Pound are trading weak while Euro and Franc remains strong.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?