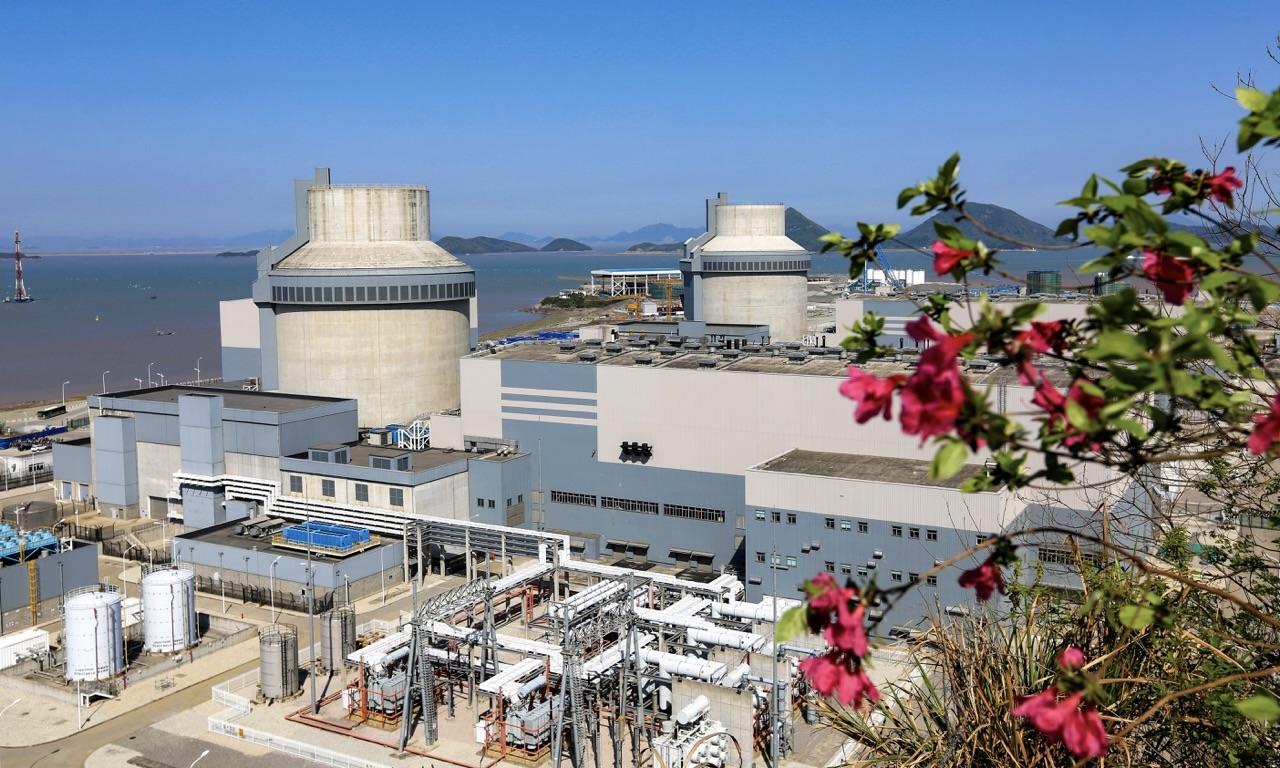

The U.S. government has entered into a landmark partnership with Canadian firms Cameco and Brookfield Asset Management, the owners of Westinghouse Electric, to construct at least $80 billion worth of new nuclear reactors. This initiative marks one of the most ambitious expansions of U.S. nuclear energy in decades, aligning with President Donald Trump’s vision to strengthen America’s energy independence through oil, gas, coal, and nuclear power.

The deal comes as the rise of artificial intelligence and hyperscale data centers drives the first major surge in U.S. electricity demand in 20 years, pressuring an already strained power grid. Under the agreement, Washington will help secure financing and fast-track permits for Westinghouse’s AP1000 and small modular reactors. In return, the U.S. government will earn a 20% share of future profits after Cameco and Brookfield receive $17.5 billion. If Westinghouse’s valuation exceeds $30 billion by 2029, the government could convert its profit share into an equity stake and potentially mandate an IPO.

Trump also revealed in Tokyo that Japan will contribute up to $332 billion to support U.S. infrastructure projects, including as much as $100 billion in reactor construction led by Mitsubishi Heavy Industries, Toshiba, and IHI.

Despite the optimism, experts warn that the plan faces major hurdles, including cost overruns, regulatory delays, and public opposition over nuclear waste. The Vogtle reactors in Georgia—completed seven years late at more than double their initial cost—serve as a stark reminder.

Still, momentum for nuclear energy is growing as tech giants like Google, Microsoft, and Amazon sign deals for advanced nuclear and fusion power to meet data center energy needs. Recently, Google and NextEra Energy agreed to restart an idle nuclear plant in Iowa, while Microsoft partnered with Constellation Energy to revive a reactor at the historic Three Mile Island site.

FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns

FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns  Anthropic Eyes $350 Billion Valuation as AI Funding and Share Sale Accelerate

Anthropic Eyes $350 Billion Valuation as AI Funding and Share Sale Accelerate  Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape

Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape  Trump Signs “America First Arms Transfer Strategy” to Prioritize U.S. Weapons Sales

Trump Signs “America First Arms Transfer Strategy” to Prioritize U.S. Weapons Sales  Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit

Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit  TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment  Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch

Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch  Instagram Outage Disrupts Thousands of U.S. Users

Instagram Outage Disrupts Thousands of U.S. Users  SpaceX Seeks FCC Approval for Massive Solar-Powered Satellite Network to Support AI Data Centers

SpaceX Seeks FCC Approval for Massive Solar-Powered Satellite Network to Support AI Data Centers  Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine

Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine  SpaceX Updates Starlink Privacy Policy to Allow AI Training as xAI Merger Talks and IPO Loom

SpaceX Updates Starlink Privacy Policy to Allow AI Training as xAI Merger Talks and IPO Loom  Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026

Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026  Oracle Plans $45–$50 Billion Funding Push in 2026 to Expand Cloud and AI Infrastructure

Oracle Plans $45–$50 Billion Funding Push in 2026 to Expand Cloud and AI Infrastructure  Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies

Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies  Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate

Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate  US Pushes Ukraine-Russia Peace Talks Before Summer Amid Escalating Attacks

US Pushes Ukraine-Russia Peace Talks Before Summer Amid Escalating Attacks