Global bond yields have largely remained in a tight range over the past week as positive news regarding the progress in Greece has been offset by a further selloff in commodities and modestly weaker-than-expected data in the US. Furthermore, the long end has outperformed on the curve in response to the somewhat hawkish testimony from Fed Chair Yellen, which led USD strengthening. The Bank of Canada cutting rates by 25bp added to the strengthening pressure; DXY has now rallied roughly 3.5% from the June FOMC meeting.

Barclays notes:

- Recent Fedspeak and latest economic projections suggest that the hurdle to begin the hiking cycle is not very high. We believe the front end is vulnerable to a selloff, given the benign path of the hiking cycle priced in.

- As a result, we recommend FFz5-z6 steepeners as a bearish alternative to being outright short the front end.

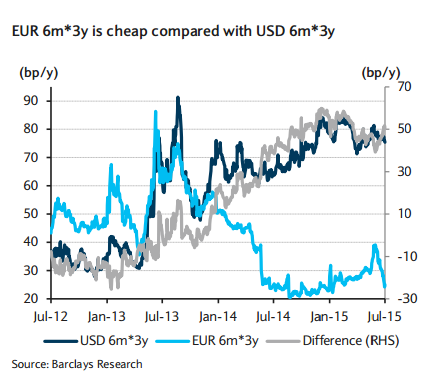

- In the conditional space, we recommend a 6m*3y ATM + 25/ATM -25 risk reversals since the market is pricing in little tail risk of higher rates.

- We remain neutral on duration further out the curve.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed