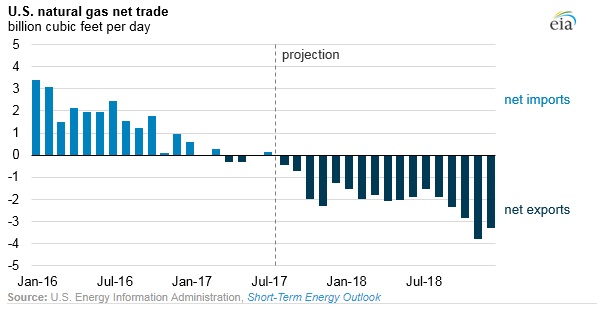

According to United States’ Energy Information Administration (EIA), the United States is set to become a net natural gas exporter by the end of 2017. This information was highlighted in EIA’s Short-term energy outlook (STEO) report that was published yesterday. According to the report, the United States has already been a net exporter of natural gas in the three of the five months of 2017. It has so far been a net exporter in February, April, and in May. This is historically significant as the United States has not been an exporter of gas since 1958.

The U.S. natural gas trade is dominated by pipelines, with pipelines from Canada supplying the vast majority of all imported gas. The TransCanada Pipeline was completed in 1958, transporting gas from western Canada to the northeastern United States. Since then, the U.S. has always imported a great deal of Canadian natural gas. Net gas imports from Canada peaked in 2007, at over 10 billion cubic feet (Bcf)/day. Since 2007, the U.S. shale boom has begun replacing Canadian gas, and the U.S. has begun to export gas to Canada in significant volumes. The U.S. is still a net importer of gas from Canada, but exports to Canada continue to rise.

The United States is currently the world's largest natural gas producer, having surpassed Russia in 2009. Natural gas production in the United States increased from 55 billion cubic feet per day (Bcf/d) in 2008 to 72.5 Bcf/d in 2016. Most of this natural gas (96 percent) in 2016 was consumed domestically. Abundant natural gas resources and large production increases have created opportunities for U.S. natural gas exports.

With a near doubling of U.S. export pipeline capacity to Mexico by 2019, EIA expects U.S. natural gas exports to increase, though they should remain well below the available pipeline capacity. Mexico’s national energy ministry (SENER) expects to increase its natural gas use for electric power generation by almost 50% between 2016 and 2020. Mexico's domestic natural gas pipeline network is undergoing a major expansion, primarily to accommodate new natural gas pipeline imports from the United States. Gas exports to Mexico are currently nearly at record levels, averaging over 4 Bcf/d in 2017. This value has increased quickly, as in 2010 the U.S. was exporting only 0.91 Bcf/d to its southern neighbor.

In addition to the pipeline exports, LNG is making a difference too. The U.S.’s natural gas with the rest of the world changed profoundly recently when Cheniere’s Sabine Pass terminal began operation. The facility set a new record of 1.96 Bcf/d in May, as it continues to spool up operations. Three liquefaction trains are currently operational, with a fourth expected to come online in the next few months. Additional expansion of Sabine Pass and a host of other LNG projects in the pipeline mean the U.S. will likely become more of a natural gas exporter in the future.