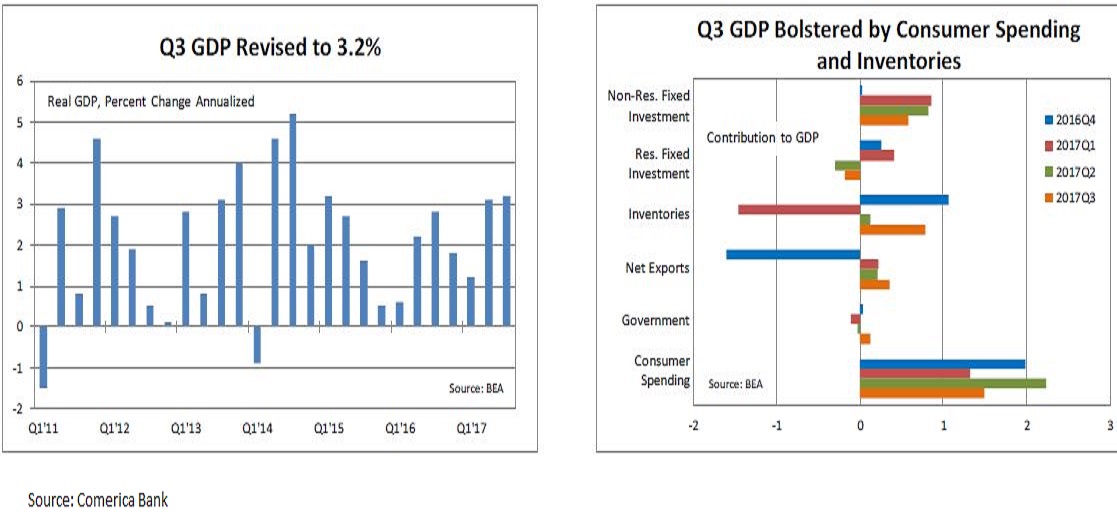

The U.S. economy is expected to generate more consistent momentum as we move deeper into 2018. It would be the first such winning streak in this expansion. In addition to more consistent U.S. momentum, global economic demand is improving. Europe and Japan are both gaining momentum after years of underperformance, Comerica Bank reported recently.

With the recent passage of tax reform, U.S. fiscal policy is stimulative. If Congress can cobble together an infrastructure spending program as promised, that could add to fiscal stimulus later this year. Although interest rates are gradually rising, monetary policy remains accommodative. The Federal Reserve has so far raised short-term interest rates from exceptionally low, to merely very low. Also, the crisis-driven regulatory response is easing.

Productivity growth is key to sustaining a long expansion. It tends to be cyclical, often peaking at the end of recessions after labor has been shed and output starts to ramp up. It often declines ahead of recessions as businesses hire more workers to keep up with growing demand. So far in this expansion, productivity growth has been weaker than expected. However, through the first three-quarters of 2017 productivity growth improved, with Q3 2017 registering 1.5 percent year-over-year productivity growth -the strongest since Q2 2015.

Productivity growth is the key lever that will determine if wage growth is inflationary or not. Strong productivity growth allows businesses to pay higher wages without raising their prices. Otherwise, wage growth can lead to higher inflation which could cause the Federal Reserve to raise interest rates more than expected, which can eventually lead to the next recession.

"We expect to see an ongoing economic expansion for the U.S. in 2018, helped by rest-of-world growth, expansive fiscal policy, and restrained monetary tightening. Productivity growth will be a key sustaining element of the U.S. expansion. By mid-year we will see the second-longest U.S. expansion ever, reaching 107 months in May," the report said.

Lastly, FxWirePro has launched Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility