US labor market has shown extraordinary strength, dumbfounding most of the market participants, economists and FED itself. Unemployment rate has dropped from its peak of 10% in late 2009 to 5.5% as of now.

However,

- Some but not all the labor market indicators have reached pre-crisis level, hence the comments from Federal Reserve that still labor market slack exists and scope remains for further improvement.

- Fall in unemployment is partially due to people exiting the labor force as seen in declining labor force participation that is hovering just around 60%.

- To add to the woe, current slowdown in basic materials, mining and oil sectors will be costing more jobs that might add upward pressure on unemployment rate.

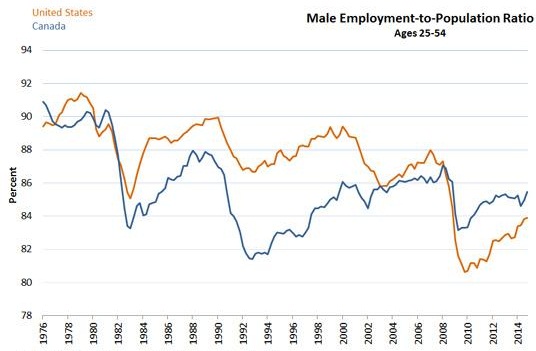

The chart from St. Louis FED, explains employment to population ratio for males in US and Canada aged 25-54, from a historical perspective.

- During the 90s, Canada faced deeper recession than US, which saw the ratio to decline sharply from 88% to just below 82% within a span of 5 years. This time however scenario seems opposite. US situation is much graver than that of Canada.

- Important to note, the ratio is in decline due to demographic and cyclical factors like greater participation of women in the workforce.

- It also important to take into account that whereas decline in the ratio over recession took just 5 years to reach bottom, recovery has taken much longer time.

Current slack might take another few years to be back at levels, which might be viewed as normal.

Labor market indicators other than NFP headline and jobless claims continue to point towards remaining slack in the market, that would be primary concern of FED, and will act against any rapid raising of interest rates.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary