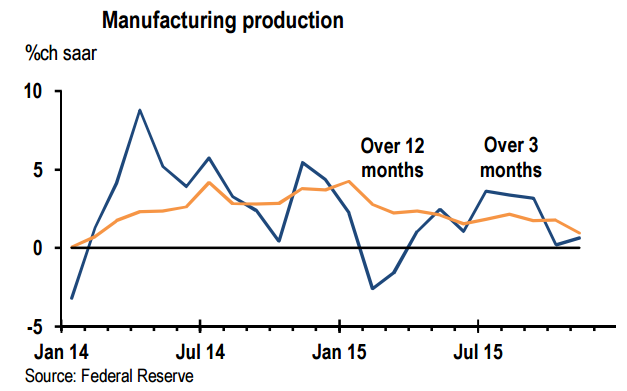

The November IP report confirmed that manufacturing continues to underperform the overall economy. Total manufacturing output was flat in November and non-auto output increased 0.1% samr. This leaves total manufacturing up only 0.8% saar so far in 4Q15 and non-auto manufacturing up 1.1%. These anemic quarterly growth rates are close to the trend in output growth over the first 11 months of the year, 1.1% saar for all manufacturing and 0.6% for non-auto manufacturing.

Moreover, December manufacturing surveys to date point to continued weakness through the end of the year. The PMI had been holding up better than other surveys, but the flash PMI for December dropped to 51.3, its lowest reading since October 2012. The key new orders component dropped to 50.5, its lowest reading since September 2009. Results from the first regional Fed surveys for December were also generally downbeat, in line with the tone of the PMI.

US manufacturing still struggling

Monday, December 21, 2015 11:39 PM UTC

Editor's Picks

- Market Data

Most Popular

Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Australia’s December Trade Surplus Expands but Falls Short of Expectations

Australia’s December Trade Surplus Expands but Falls Short of Expectations  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns