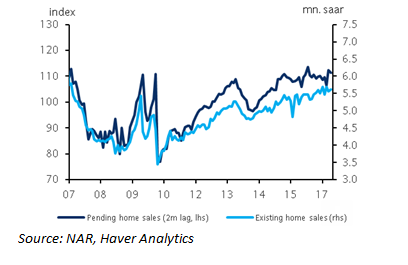

U.S pending home sales dropped unexpectedly in May. The lack of inventory continues to undermine home sales. Pending home sales dropped 0.8 percent on a sequential basis in May, falling for the third straight month. Consensus expectations were for the sales to rise 0.8 percent. The drop in home sales comes in spite of low mortgage rates and solid buyer traffic.

The fall in purchase contracts comes on the heels of a downwardly revised print for April and marks the third consecutive decline for the series. The Midwest region performed the best of all the regions, with pending sales remaining stable. Following a downwardly revised 5.7 percent reading, pending sales in West dropped 1.3 percent in May.

Housing demand in the U.S. is strong, as seen by the rebounding trend for purchase plans. However, low inventories are seemingly keeping several would-be-buyers on the sidelines, noted Wells Fargo in a research report.

While low inventories are expected to be the main reason behind undermining home sales, seasonal distortions are still at play. Pending sales rose sharply in February on unseasonably mild weather.

Overall, the data released today was dismaying; however, pending home sales continue to be at levels in line with a modest rebound in the housing sector this year, stated Barclays in a research report.

At 17:00 GMT the FxWirePro's Hourly Strength Index of US Dollar was slightly bearish at -66.2778. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

U.S. pending home sales drops for third straight month in May

Wednesday, June 28, 2017 5:41 PM UTC

Editor's Picks

- Market Data

Most Popular