The FOMC left the Fed Funds Rate unchanged at 0.25-0.50 percent as widely expected by markets. The committee voted 7-3 in favour of the decision. It was the first time since September 2011 that so many members opposed the majority in favour of a hike. Including the non-voting members, fourteen out of the seventeen still expected at least one hike before the end of the year.

Growing support seen in the hawkish block of the Fed suggested that momentum for a hike is building. Esther George (Kansas City) who has become the most visible hawk this year has been joined by Loretta Mester (Cleveland) and Eric Rosengren (Boston). Yellen’s press conference was also seen preparing the markets for a hike later this year, however, rate path has become more gradual than before.

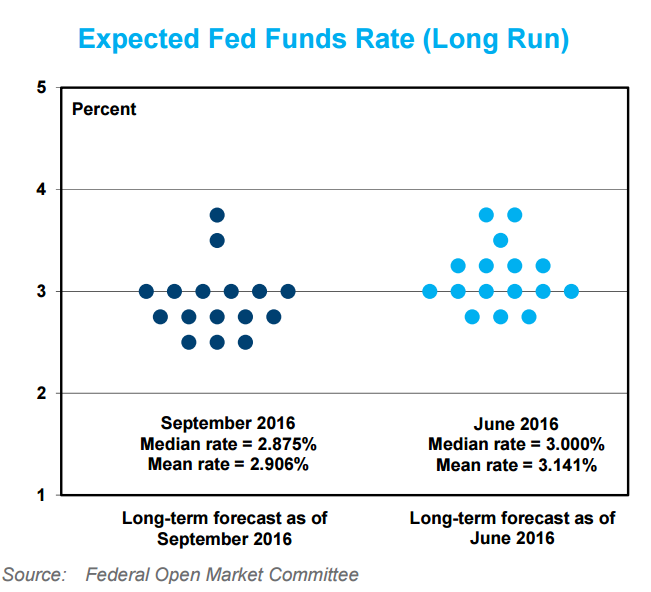

The Committee was again more dovish with respect to the outlook for future policy than it was three months ago. The Committee’s median expectation for the Fed Funds Rate at end-2017 now implies just two hikes next year to 1.00-1.25 percent and just three hikes in 2018 to 1.75-2.00 percent. And the FOMC revised down its median assessment of the long-run equilibrium Fed Funds Rate for the fourth out of the past five forecast updates to below 3 percent.

The Fed attempted to retain a hawkish bias in the subsequent rhetoric, but maintained the caveat of data dependency. Although Yellen stressed the Fed’s independence of partisan politics, hike before Election Day (Nov 8) may evoke political repercussions, which the Fed can ill afford. This makes December the most likely outcome for the next hike.

The markets reacted accordingly, US yields fell, the USD was under pressure, while higher yielders outperformed. Equities and commodities benefitted. Follow through price action is expected and then the markets will lurch around positive and negative data. EUR/USD was 0.45 percent higher on the day, trading at 1.1235 at around 11:45 GMT.

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  ECB Signals Steady Interest Rates as Fed Risks Loom Over Outlook

ECB Signals Steady Interest Rates as Fed Risks Loom Over Outlook  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  China Holds Loan Prime Rates Steady in January as Market Expectations Align

China Holds Loan Prime Rates Steady in January as Market Expectations Align  U.S. Urges Japan on Monetary Policy as Yen Volatility Raises Market Concerns

U.S. Urges Japan on Monetary Policy as Yen Volatility Raises Market Concerns