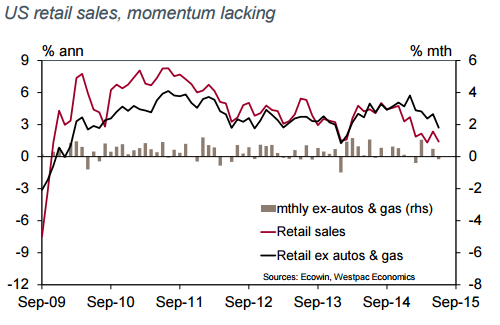

US retail sales disappointed in June, falling 0.3%. This result was partly attributable to weaker auto sales; however, core retail sales (ex autos and gas) still fell 0.2% in the month. In annual growth terms, momentum has steadily edged lower in recent months, with the June prints for total and core retail sales growth of 1.4%yr and 2.7%yr well below their respective peak growth rates, of 5.7%yr (Jan-15) and 5.1% (Nov-14).

A continued improvement in the labour market; robust consumer confidence; and firming expectations around incomes all point to stronger discretionary spending. Yet, as has been the case throughout this recovery, caution is likely appropriate.

"In July we anticipate a moderate rebound from recent weakness, with headline growth of 0.4%," says Westpac Research.

US retail sales likely to rebound in July

Sunday, August 9, 2015 10:23 PM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022