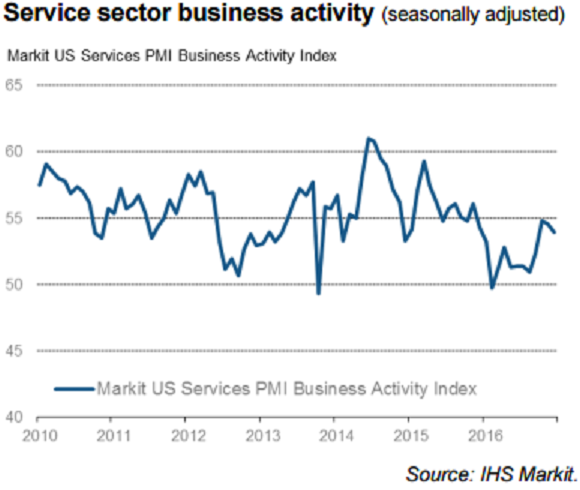

Growth in service sector activity eased during the month of December, while job creation accelerated at the fastest pace in near 16 months, highlighting a sustained upturn in business activity and incoming new work across the U.S. service sector. Greater workloads and improved confidence towards the business outlook, in turn, contributed to the fastest rise in payroll numbers since September 2015.

At 53.9 in December, the seasonally adjusted Markit final U.S. Services Business Activity Index dropped from 54.6 in November to signal the slowest upturn in service sector activity for three months. Nonetheless, the latest reading was well above the neutral 50.0 threshold and pointed to a solid pace of expansion. Moreover, the average reading during the final quarter of 2016 (54.4) was the strongest since Q4 2015.

Service providers reported a robust and accelerated upturn in payroll numbers at the end of the year. The rate of job creation was the fastest since late-2015, which survey respondents linked to ongoing expansion plans and rising confidence regarding the business outlook.

December data signaled a further rebound in business optimism from the post-crisis low seen in June, and the latest reading was one of the highest recorded since the summer of 2015. A number of firms also pointed to increased food costs. Latest data indicated a solid rise in average prices charged by service providers and the rate of inflation was the steepest recorded since June 2015.

Meanwhile, the dollar index traded at 101.58, up 0.06 percent, while at 4:00GMT, the FxWirePro's Hourly Dollar Strength Index remained slightly bearish at -86.94 (a reading above +75 indicates a bullish trend, while that below -75 a bearish trend). For more details, visit http://www.fxwirepro.com/currencyindex

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off