Saudi Arabia has ignored calls for any production cut instead pursuing oversupply strategy to push prices lower in a bid to crowd out the market. Lower price was expected to push producers in North America to cut production.

However that has not been the case so far.

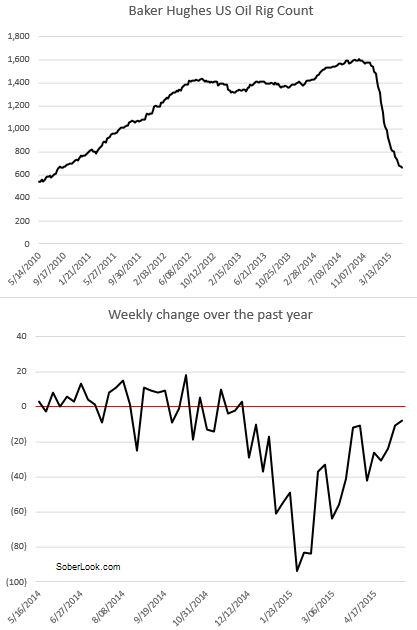

- US active oil rig counts has fallen to lowest level since 2011, down almost 60% from their peak of 1600 last year. Price had fallen similarly close to 50%. All of these did little to cut back production. US producers are still producing at record pace of 9.3 million barrels and price has come back up almost 30% from their lows made early this year.

Fall pattern in US oil rig count, as shown in the chart from Soberlook.com, reveal why Saudi strategy would find it difficult to succeed.

- At one point US producers were cutting rigs at rapid pace, reaching almost 100 per week in January 2015 while oil price rout continued. However cuts have slowed since then, reaching about 10 per week as per latest data. Reduction rate seems to be highly correlated to price. As price rebound, cuts slowed.

- Moreover, in spite of their high production cost it is fairly easier for shale producers to witch on and off a production rig and boost efficiency in any particular rig.

Shale producers will adapt to lower price.

- Since the beginning of Shale oil boom in US, producers are for the first time facing the shock of lower oil price. Talks are already in circulation that shale producers re taking large steps to cut back on costs and hiring experts from other industries such as manufacturing to improve production and supply chain management.

WTI is currently trading at $58.5/barrel. In spite of recent rally, expect price to remain capped for longer term. Current rally, still might have some juice left, however pushing price over $70-75/barrel would be daunting task.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate