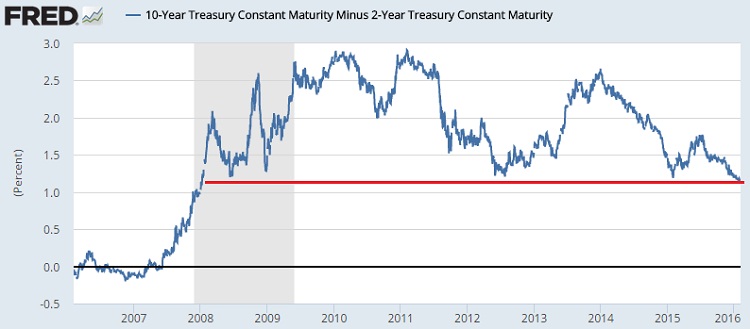

As investors pile up money into safety of treasuries, US yield curve is flattening it out. Market is easing for itself. When FED takes up actions and introduce dovish policy, this is the kind of curve flattening takes place.

10 year treasury yield is now hovering well below 2% and today's selloffs indicate, it is likely to drop more by weekend.

Spread between 10 year and 2 year treasury has fallen to closer to 1%, a level not seen since early 2008, at a time when US economy fell into recession. Even then the spread was on the rise. We expect, the spread to shrink further. Due to expectations for FED hike to be most probable next path, has kept short term rates well anchored, despite recent setback.

Tomorrow, FED chair Janet Yellen will be testifying in house of representatives and if she drops a hint that FED is also open to further easing, then the spread might reverse recent fall as short curve would fall more. That is not likely to bear well for Dollar.

Market has already pushed back expectations for rate hike from twice this year to nil.

Dollar index is currently trading at 96.72, up 0.05% for the day.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed