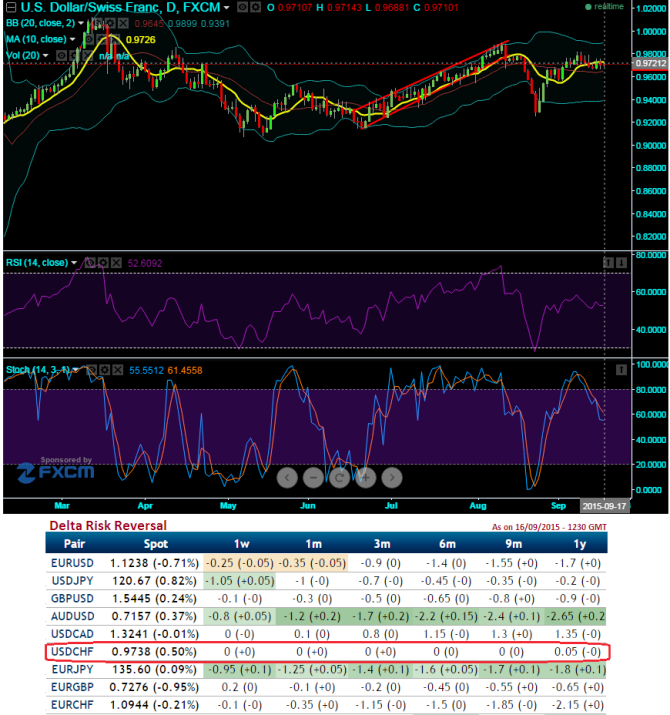

USDCHF pair has been absolutely non-directional and puzzling from mid August, earlier to which the pair was moving well within the range. For short term traders the pair seems to remain in range between 0.9815 on north and 0.9575 levels on south as the RSI oscillator is converging with sideway trend, while slow stochastic curve maintained %D crossover which signifies overbought pressures which is why we kept slightly more targets below.

From the above nutshell showing delta risk reversal of G10 space we can identify both calls and puts have been fairly priced in according to the non-directional trend which we've already mentioned above. Although shorting an ATM call confines the upside potential of the hedge, a few risk averse or laggards thinks that it is more important to be hedged at minimal cost. To that end, one of the most popular risk reversals is the zero cost risk reversal where you don't have to pay a premium.

Why use a risk reversal: You would enter into a risk reversal if you want to hedge your underlying risk while lowering the cost of this premium.

For an instance, you can buy a USD/CHF call to cover the risk of an increase in the value of the underlying asset. Simultaneously, you sell a USD/CHF put. Although the put limits any upside should the underlying actually fall in value, it also significantly reduces the cost of the overall strategy.

Any existing shorts in underlying position, then you would buy a risk reversal (long on call and short on put) and Long underlying position you would sell a risk reversal (i.e. long on put and shorts on call).

USD/CHF delta risk reversal moving in sync with narrow range trend

Thursday, September 17, 2015 6:31 AM UTC

Editor's Picks

- Market Data

Most Popular

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate