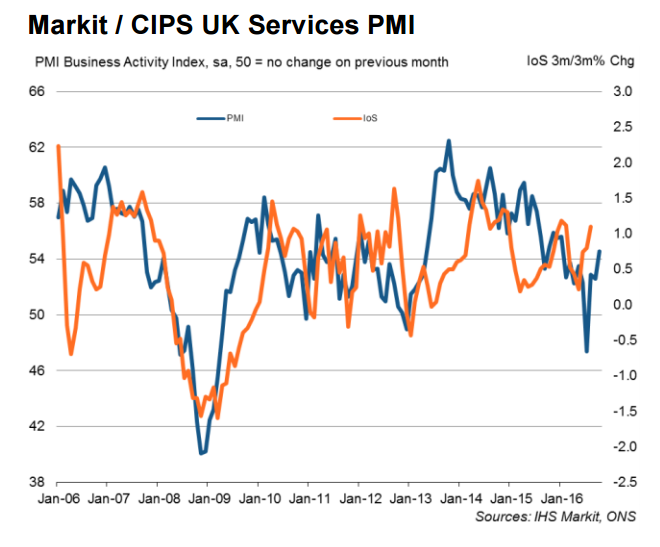

Britain's services sector accelerated in October, according to the latest PMI data from IHS Markit, released on Thursday. The UK Markit/CIPS October PMI services sector index strengthened to 54.5 from 52.6 the previous month, beating forecast of 52.5 and also the strongest figure since January. The headline balance is well above the pre-referendum reading of 52.3, although still a little shy of the long-term average of 55.1.

Orders accelerated to the strongest level in nine months. The forward-looking business expectations component, a more reliable guide to official estimates of service sector output posted another rise to 69.1 from 66.4 in September, the strongest since May. The pace of employment growth also held broadly steady and in line with its long-term average.

Data is likely to maintain expectations of solid GDP growth in the short term, especially given the dominance of the services sector in the economy. The Bank of England left interest rates unchanged as widely expected and ramped up its growth forecasts for 2017. The data will ease worries about the economic impact of a "hard" Brexit while further reducing the likelihood of additional Bank of England monetary stimuli.

That said, evidence of mounting price pressures will complicate the Bank of England's mission to keep the economy on a stable course. As in the manufacturing and construction PMI reports, price pressures were evident in today's services PMI data. The input price balance rose to 64.9 from 58.9 (the highest since March 2011) and the prices charged balance firmed to 53.3 from 52.8 (the highest since April 2011).

The effects of a weaker pound are clearly evident. Costs are consequently rising at the fastest rate for over five years. If sustained, the increase in prices threatens to curb both corporate hiring and consumer spending, as firms seek to reduce staff costs and households see their pay eroded by rising inflation.

"An encouraging picture of the economy gaining further growth momentum in October is marred by news that inflationary pressures are rising rapidly," said Chris Williamson at Markit.

Cable spiking as we write, $1.25 levels in sight after Bank of England ditches plans for another rate cut. GBP/USD was up 1.41 percent at 1.2477 at 12:15 GMT, while EUR/GBP was at 0.8870, down 1.64 percent.

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings