The announcement of Robert F. Kennedy Jr. as President-elect Donald Trump's pick for Secretary of Health and Human Services (HHS) has sent shockwaves through the pharmaceutical industry, sparking a sharp sell-off in vaccine stocks on Friday. With RFK Jr.’s long history of vaccine skepticism, investors are bracing for major changes in public health policy, leading to a ripple effect across the biotech sector.

Markets React to RFK Jr.’s Controversial Nomination

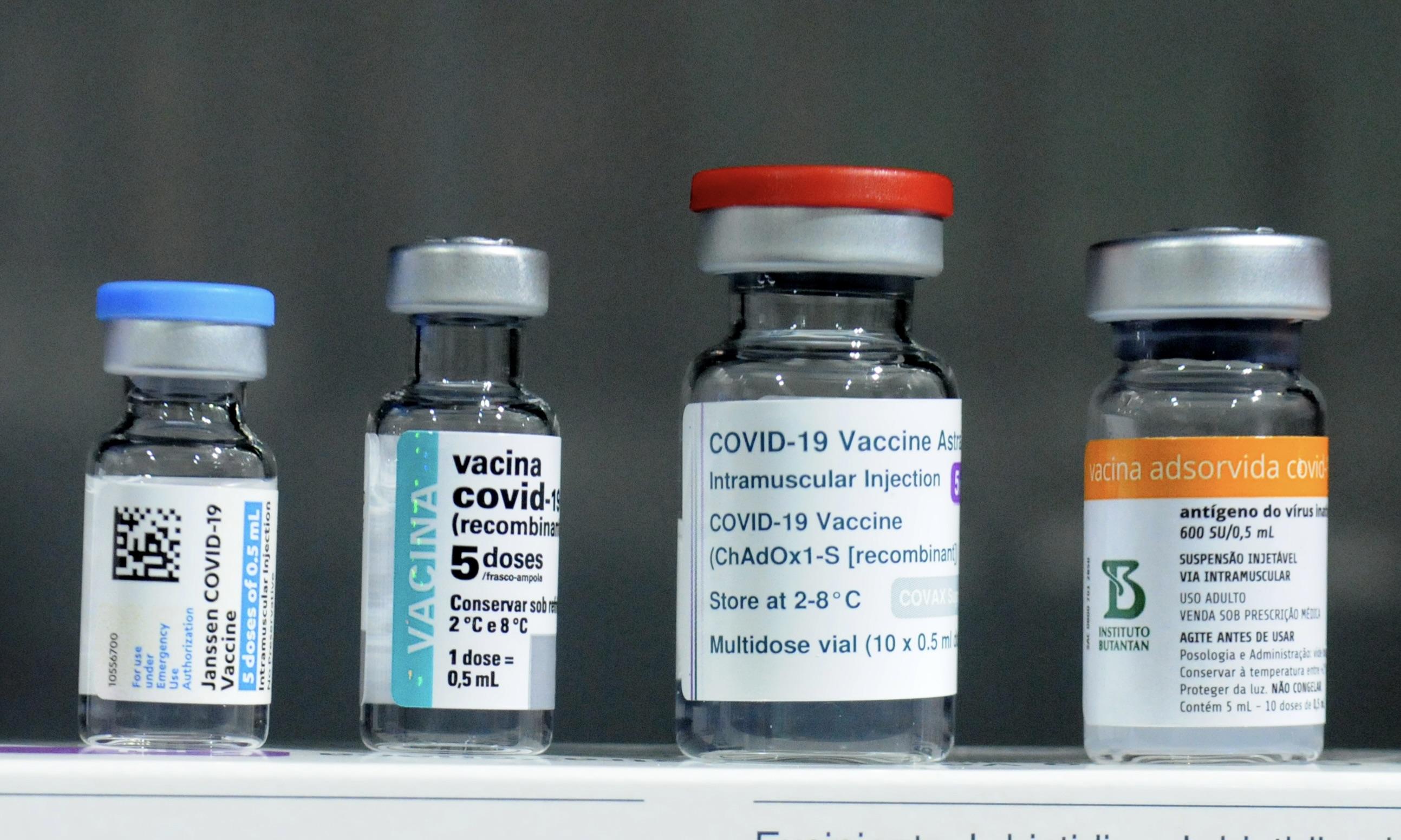

Shares of major vaccine makers, including Pfizer and Moderna, took a nosedive following the announcement. Pfizer saw a drop of over 3%, while Moderna plummeted more than 7%. Other biotech giants like GSK and AstraZeneca also suffered losses, declining 2% and 3%, respectively. The broader SPDR S&P Biotech ETF slumped nearly 4%, reflecting the market's growing unease over Kennedy’s potential impact on the industry.

Kennedy has been a vocal critic of vaccines and a long-time advocate of overhauling the U.S. Food and Drug Administration (FDA). In recent remarks, he accused the FDA of prioritizing pharmaceutical profits over public health and vowed sweeping reforms if confirmed to the HHS post.

Industry on Edge

The pharmaceutical industry, already under scrutiny for high drug prices, now faces a new level of uncertainty. Kennedy’s appointment raises fears of policy shifts that could hinder vaccine development and rollout. The Pharmaceutical Research and Manufacturers of America (PhRMA), a prominent lobbying group, expressed cautious optimism in a statement, saying it aims to collaborate with the Trump administration to prioritize patient health.

However, insiders warn that Kennedy’s leadership could disrupt long-standing public health strategies. Analysts fear that RFK Jr.’s controversial stance on vaccines might lead to reduced federal support for immunization programs, thereby impacting both public health outcomes and corporate revenues.

Economic Implications

The market turmoil reflects broader concerns over Trump’s latest cabinet appointment. Analysts from Jefferies note that vaccine companies rely heavily on government contracts and public immunization campaigns for revenue. Any policy shift under RFK Jr. that undermines vaccine uptake could deal a significant blow to the industry.

While RFK Jr.’s supporters champion his anti-establishment stance, critics argue his skepticism toward vaccines could lead to dangerous public health consequences. The Centers for Disease Control and Prevention (CDC) has repeatedly stressed the importance of immunization in preventing outbreaks of diseases like measles, polio, and influenza. Kennedy’s appointment may embolden anti-vaccine sentiments, creating a potential public health crisis.

Future Uncertainty Looms

As Wall Street digests the news, questions abound about the long-term implications of RFK Jr.’s nomination. Some speculate that pharmaceutical companies may ramp up lobbying efforts to counter any policy changes. Meanwhile, public health experts are urging Congress to scrutinize Kennedy’s views during the confirmation process.

The nomination has added yet another layer of complexity to a post-election landscape already marked by volatile markets and policy uncertainty. As the Trump administration prepares to take office, the biotech industry is left wondering what lies ahead for public health policy—and its bottom line.

BlueScope Steel Shares Drop After Rejecting Revised A$15 Billion Takeover Bid

BlueScope Steel Shares Drop After Rejecting Revised A$15 Billion Takeover Bid  Samsung Electronics Stock Poised for $1 Trillion Valuation Amid AI and Memory Boom

Samsung Electronics Stock Poised for $1 Trillion Valuation Amid AI and Memory Boom  Stock Market Movers: Dell, Block, Duolingo, Zscaler, CoreWeave, Autodesk, Rocket, MARA

Stock Market Movers: Dell, Block, Duolingo, Zscaler, CoreWeave, Autodesk, Rocket, MARA  China’s New Home Prices Post Sharpest Drop Since 2022 Amid Ongoing Property Slump

China’s New Home Prices Post Sharpest Drop Since 2022 Amid Ongoing Property Slump  Ecuador Raises Tariffs on Colombian Imports to 50% Amid Border Security Dispute

Ecuador Raises Tariffs on Colombian Imports to 50% Amid Border Security Dispute  Meta Signs Multi-Billion Dollar AI Chip Deal With Google to Power Next-Gen AI Models

Meta Signs Multi-Billion Dollar AI Chip Deal With Google to Power Next-Gen AI Models  Trump Touts Stock Market Gains and 401(k) Boost Amid Tariff Uncertainty

Trump Touts Stock Market Gains and 401(k) Boost Amid Tariff Uncertainty  MOEX Russia Index Hits 3-Month High as Energy Stocks Lead Gains

MOEX Russia Index Hits 3-Month High as Energy Stocks Lead Gains  Gold Prices Rally in February as Geopolitical Risks and Economic Uncertainty Boost Safe-Haven Demand

Gold Prices Rally in February as Geopolitical Risks and Economic Uncertainty Boost Safe-Haven Demand  Toyota Plans $19 Billion Share Sale in Major Corporate Governance Reform Move

Toyota Plans $19 Billion Share Sale in Major Corporate Governance Reform Move  USITC to Review Impact of Revoking China’s PNTR Status, Potentially Raising Tariffs on Chinese Imports

USITC to Review Impact of Revoking China’s PNTR Status, Potentially Raising Tariffs on Chinese Imports  Strait of Hormuz Oil and LNG Shipments Disrupted After U.S.-Israel Strikes on Iran

Strait of Hormuz Oil and LNG Shipments Disrupted After U.S.-Israel Strikes on Iran  Netflix Stock Jumps 14% After Exiting Warner Bros Deal as Paramount Seals $110 Billion Acquisition

Netflix Stock Jumps 14% After Exiting Warner Bros Deal as Paramount Seals $110 Billion Acquisition  Asian Markets Slide as Nvidia Earnings, U.S.-Iran Tensions and AI Valuations Weigh on Investor Sentiment

Asian Markets Slide as Nvidia Earnings, U.S.-Iran Tensions and AI Valuations Weigh on Investor Sentiment  Venezuela Oil Exports to Reach $2 Billion Under U.S.-Led Supply Agreement

Venezuela Oil Exports to Reach $2 Billion Under U.S.-Led Supply Agreement  Flare, Xaman Roll Out One-Click DeFi Vault for XRP Yield via XRPL Wallets

Flare, Xaman Roll Out One-Click DeFi Vault for XRP Yield via XRPL Wallets