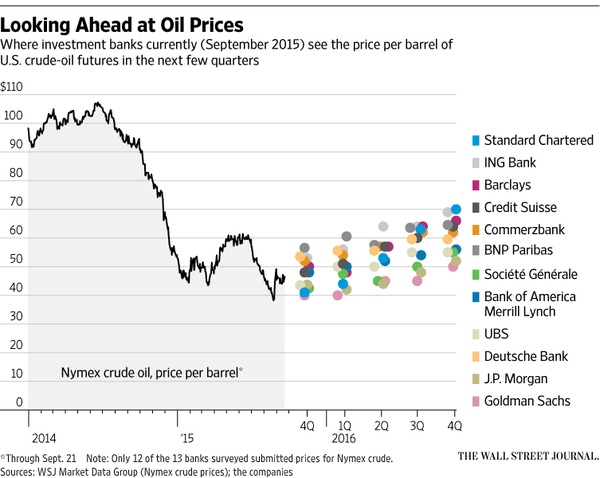

Latest survey by prominent newspaper Wall Street journal shows that most of the invest banks are expecting oil to stay below most parts of 2016.

- Investment bank Goldman Sachs is the most bearish among bankers, which is expecting price to rise slowly through 2016 but remain below $50.

- On the other hand BNP Paribas and ING bank are most bullish among bankers. BNP expects price to reach $60/barrel by second quarter of 2016, while ING is expecting price to reach $70/barrel by fourth quarter of 2016.

- Standard Chartered and Barclays expect prices to rise relatively faster after second quarter to trade around $70/barrel.

One thing can be read from the survey that no investment banks are expecting prices to dip below $40/barrel next year and none is expecting much deterioration from here even in this year.

Kindly note that Goldman has indicated that price might go as low as $20/barrel in certain scenario but that is not their base case.

WTI is currently trading at $46.8/barrel and Brent at $2.6/barrel premium.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary