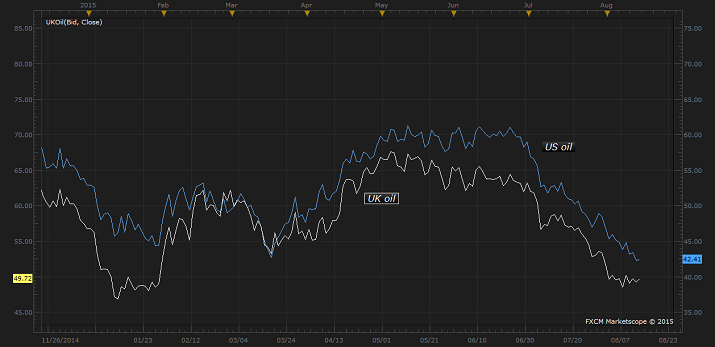

Today WTI dropped to new six year low since the rout started 14 months ago, in June 2014. WTI CFDs (contract for difference) traded as low as $39.55/barrel.

Today at one point, Brent - WTI spread rose to almost $10/barrel, suggesting that the market is increasingly believing the idea that supply glut in the oil market is an US phenomenon and as long as US export ban remains in place, Brent benchmark is at lesser risk than WTI.

WTI however, has jumped back sharply after the initial fall, while Brent remains stagnant with low volatility. If the theme of North American supply glut intensifies Brent-WTI spread might widen further.

- While removal of sanctions over Iran remains bearish for Brent, slight production drop from Saudi Arabia remains positive. Moreover, several consecutive price hikes from Saudi Arabia for Asian customers, suggest that demand remains healthy in Asia.

- On the other hand, total crude stocks in US, including the strategic reserve remains at highest in more than 80 years at 1 billion barrel.

WTI is currently trading at $42.3 per barrel and Brent at $7.4/barrel premium.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?