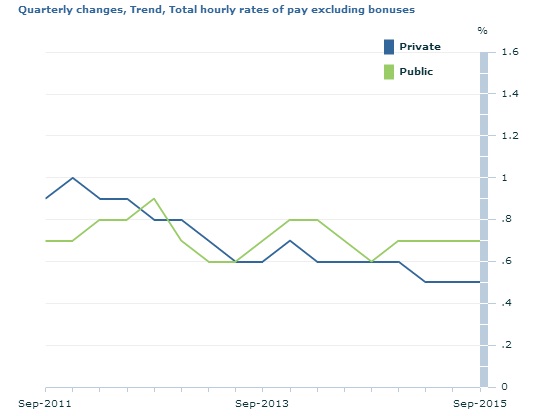

To add to the concern of Reserve Bank of Australia (RBA) is the latest wage report, which showed wage growth is at lowest level since 1998. In October, unemployment rate dropped by 0.3% to 5.9% and employment rose by 58,600, but that doesn't seem to have helped wages much.

- For three months to September quarter, wages grew by 0.6% on quarterly basis and 2.3% annual pace. Annual pace of growth stands at lowest since 1998. Major contributor has been public sector, where wages grew by 2.7%. Public sector growth has been 2.1%.

- Lowest level of growth was registered at 1.5% annually for Professional, scientific and technical services and administrative and support services, while best was seen for education and training at 3% annually.

- On quarterly basis, accommodation and food services recorded best wage growth of 1.6%, while financial and insurance services recorded lowest at 0.2%.

Lower wage growth indicates that Australian Labour market is not tight enough. Without wage growth, it would be difficult for RBA to achieve demand driven inflation.

Aussie is currently trading at 0.71 against Dollar.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings