Market is trying to gauge the probability of a September hike from FED and today's ADP number might have poured some cold water over.

- ADP is a good precursor of NFP report, which is scheduled at 12:30 GMT Friday. Dollar could find its upward groove back if NFP reverses ADP's loss.

Key highlights -

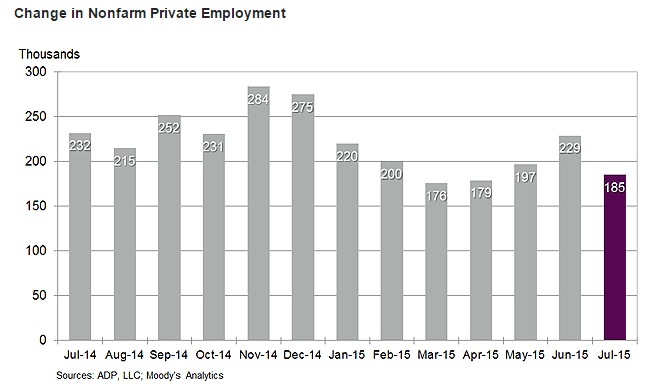

- Non-farm private sector employment grew at 185,000 in July, lowest since April. Median expectation was for 215,000. June payroll got revised by -8000 to 229,000.

- Small business sector hiring at 59,000, compared to 120,000 last month.

- Employment in franchise increased by 33,300.

- Mid-sized companies added 62,000 jobs.

- Large sector added 64,000 jobs.

- Manufacturing sector created 2000 jobs.

- 8000 jobs were added in goods producing sector.

- Construction sector added 15,000 on payroll.

- Services sector employment remains robust as payroll added 178,000 people in May.

Since Payroll stayed above 170,000 mark Dollar was able to hold of larger loss, with some thanks to ultra-hawkish comments from Dennis Lockhart.

FXCM US Dollar index is currently trading at 12013, down from resistance around 12050-12060 and heading to support around 11980 area.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings