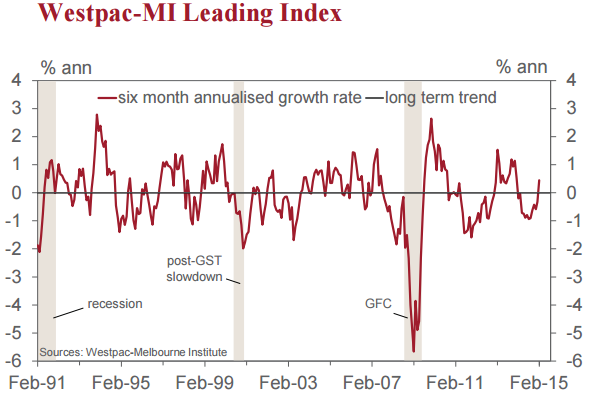

This is the first above trend reading from the Leading Indexsince January 2014. After showing persistently weak, sub-trendmomentum over the last 12 months, this is the most promisingresult in quite some time.

It suggests that the Australian economy will start to regain some momentum towards then end of this year, although it remains to be seen how well this pick-up is sustained.

The 1.36ppt swing in the Index growth rate since September,from 0.91% below trend to +0.45% above trend, has beendriven by five of the eight Index components.

Just over half of the improvement has come from reduced negative 'drags' from commodity prices (+0.54ppts), which have been broadly flat in AUD terms, and from aggregate monthly hours worked (+0.26ppts).

The rest of the improvement has come from solid post-rate cut lifts in the Westpac MI Consumer Sentiment Expectations Index (+0.33ppts) and the ASX200 (+0.21ppts), and from a continued surge in dwelling approvals (+0.15ppts).

Westpac notes as follows:

The six month annualised deviation from trend growth rate of the Westpac Melbourne Institute Leading Index, which indicates the likely pace of economic growth three to nine months into the future, lifted from -0.32% in January to +0.45% in February.

Westpac-MI Leading Index indicates Australian economy to regain momentum towards end-2015

Wednesday, March 18, 2015 5:44 AM UTC

Editor's Picks

- Market Data

Most Popular

4

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX