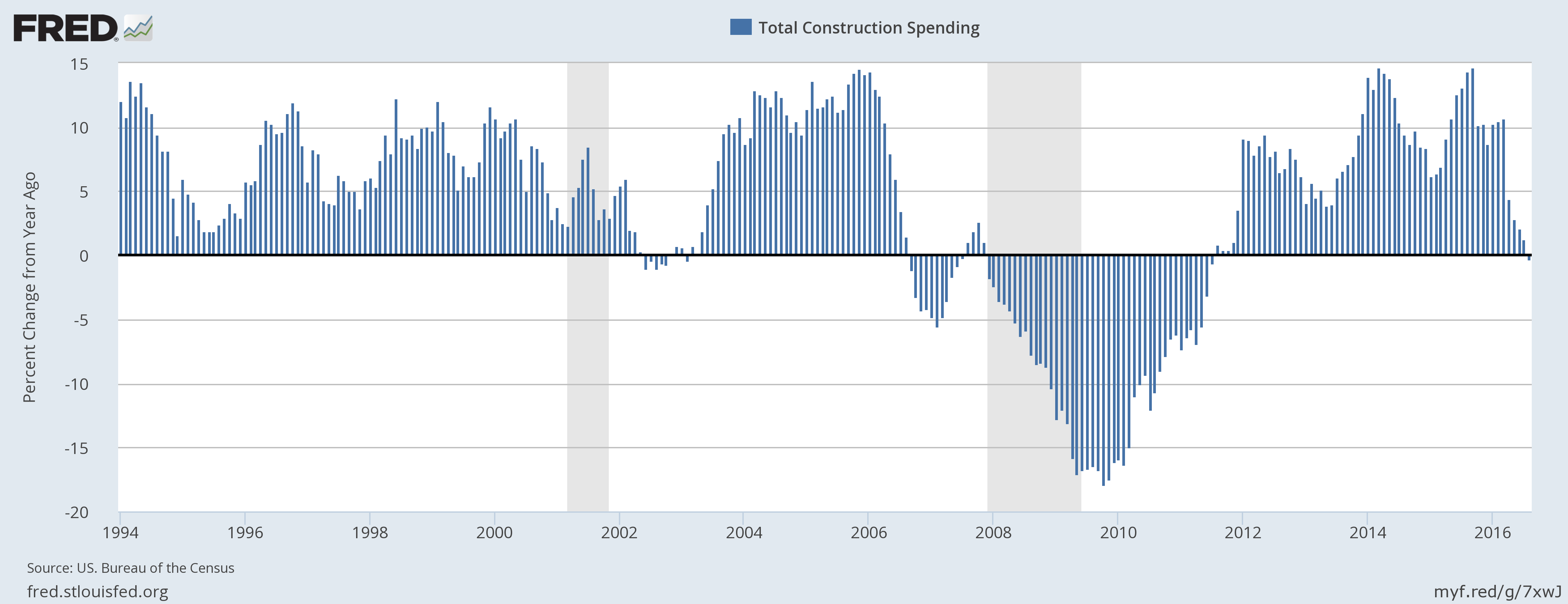

According to latest data released this week, construction spending in the United States declined for the fourth time in five months. Since April, spending has declined every month except for in July, when it remained flat on a monthly basis. On a yearly basis, spending has shrunk for the first time in five years by -0.3 percent. The last time it was negative was back in July, when it shrank by -0.6 percent. However, the last time it moved from the positive territory to the negative one was back in December 2007, the onset of the great recession.

One of the major contributors to the decline in construction spending has been the lower commodity prices, especially the energy prices, which has reduced spending in new projects or in up gradation of the current facilities. Trillions of dollars’ worth of spending have been shelved by corporations since 2015.

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility