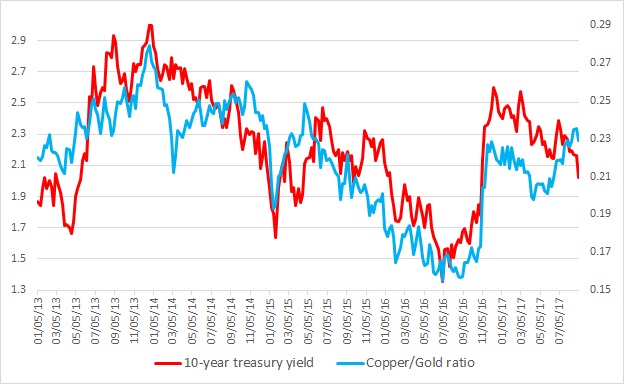

This chart shows the relation between the copper/Gold ratio and the U.S. 10-year yield constant maturity since 2013. It is visible even with the naked eye that the ratio and the yield have enjoyed a close relationship. Any divergence was temporary.

Last major divergence occurred back in 2014 when since March that year the ratio moved higher while the yield continued its decline. This continued until October before the collapse took place beginning November of that year.

What is the significance of the ratio?

- Copper is considered as an industrial barometer and pro-growth, while gold is considered as a safe haven and anti-growth. So higher ratio usually indicates increased economic activities, which in turn leads to higher interest rates/yield. Back in 2014, the ratio moved higher anticipating better than expected growth while yield moved higher but the ratio collapsed as the economy slowed down. Even the U.S. Federal Reserve had to lower its rate forecast.

Warning sign:

- A divergence is ongoing since April. The ratio has been moving higher while the yields are moving down. So the question is, how the divergence might end – higher yields or economic collapse.

BOJ Signals Possible April Rate Hike as Ueda Eyes Inflation and Wage Growth Data

BOJ Signals Possible April Rate Hike as Ueda Eyes Inflation and Wage Growth Data  Bank of Korea Holds Interest Rate at 2.50% as Growth Outlook Improves Amid AI Chip Boom

Bank of Korea Holds Interest Rate at 2.50% as Growth Outlook Improves Amid AI Chip Boom  Gold Prices Rebound as U.S. Tariffs, Fed Policy and Iran Talks Drive Market Sentiment

Gold Prices Rebound as U.S. Tariffs, Fed Policy and Iran Talks Drive Market Sentiment  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  USITC to Review Impact of Revoking China’s PNTR Status, Potentially Raising Tariffs on Chinese Imports

USITC to Review Impact of Revoking China’s PNTR Status, Potentially Raising Tariffs on Chinese Imports  Stock Market Movers: Dell, Block, Duolingo, Zscaler, CoreWeave, Autodesk, Rocket, MARA

Stock Market Movers: Dell, Block, Duolingo, Zscaler, CoreWeave, Autodesk, Rocket, MARA  U.S.-Canada Trade Talks Resume as Trump Administration Reviews USMCA

U.S.-Canada Trade Talks Resume as Trump Administration Reviews USMCA  Strait of Hormuz Oil and LNG Shipments Disrupted After U.S.-Israel Strikes on Iran

Strait of Hormuz Oil and LNG Shipments Disrupted After U.S.-Israel Strikes on Iran  Asian Markets Slide as Nvidia Earnings, U.S.-Iran Tensions and AI Valuations Weigh on Investor Sentiment

Asian Markets Slide as Nvidia Earnings, U.S.-Iran Tensions and AI Valuations Weigh on Investor Sentiment