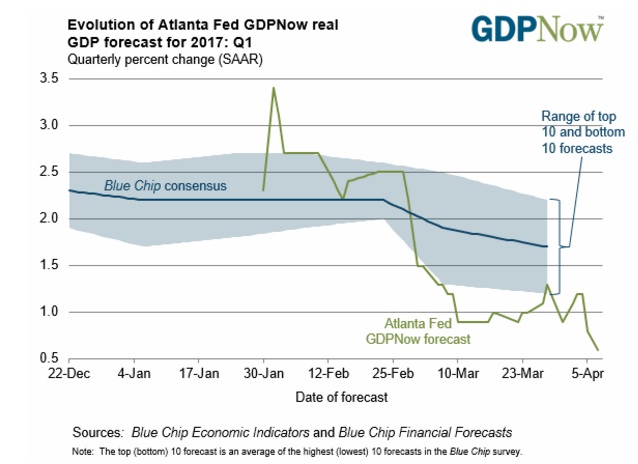

According to the Atlanta Fed’s GDP now model, the US economy grew at an annual pace of just 0.6 percent in the first quarter of 2017, which is the weakest pace of growth since 2014, when the economy shrank in the first quarter. Anyone thinking that the Trump Presidency and heightened optimism both among consumers and businesses, would deliver a faster economic growth immediately, should think again. Atlanta Fed revised its previous forecast of 0.8 percent. The Atlanta Fed’s GDPNow forecast was lowered as a result of factors including disappointing data on US auto sales, services sector employment growth, and March jobs data, which was much weaker than expected at just 98,000. Several research houses have noted the growing divergence between the soft data which are survey based and actual hard data. For example, a Bloomberg survey is still pointing at 2.5 percent growth in the first quarter compared to the 0.6 percent forecasted by GDPNow.

However, one must note that the US growth has long been weak in the first quarter, largely due to cyclical factors and adjustments. So it is not a very good indicator of the upcoming quarters. Nevertheless, a weaker growth would sharpen the attacks of the Trump opponents.

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022