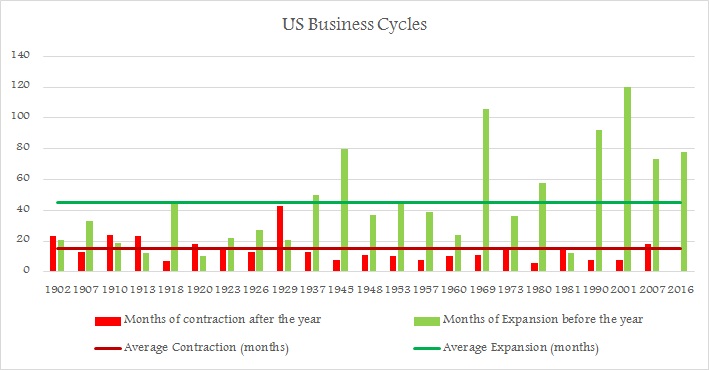

Last time US faced business cycle contraction dates back to 2007, at a time of great recession, which finally ended in June 2009 and it has been expanding since then.

Though it is very difficult to gauge how the world would have been without the support from US Federal Reserve, but one thing can be said with some degree of certainty contractionary cycle could have been much larger. In 2007 business cycle contracted for long 18 months, which is higher than last 115 years average of 15 months but much lower than that occurred during great depression, when business cycle contracted for record 43 months, according to data from National Bureau of Economic Research (NBER).

So key questions worrying us, as FED and other central banks are coming to the end of monetary policy expansion viz. a viz. support, is it going to be the end for expanding business cycle, especially since corporate profits are in decline.

Latest US business cycle that has been expanding, has now continued growth for 78 months, much higher than 45 months average of last 115 years.

However, what giving us hope, business cycles' expansionary leg has increased in average since 1970, averaging around 71 and last three business cycle averaged about 95 months, in thanks to 120 months long expansion before dot com bubble burst.

Nevertheless it is vital to recognize, we are slowly closing into rarest of the stretch (check figure).

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022