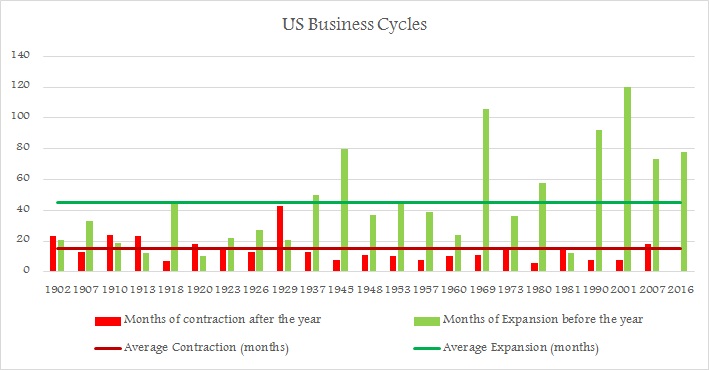

Last time US faced business cycle contraction dates back to 2007, at a time of great recession, which finally ended in June 2009 and it has been expanding since then.

Though it is very difficult to gauge how the world would have been without the support from US Federal Reserve, but one thing can be said with some degree of certainty contractionary cycle could have been much larger. In 2007 business cycle contracted for long 18 months, which is higher than last 115 years average of 15 months but much lower than that occurred during great depression, when business cycle contracted for record 43 months, according to data from National Bureau of Economic Research (NBER).

So key questions worrying us, as FED and other central banks are coming to the end of monetary policy expansion viz. a viz. support, is it going to be the end for expanding business cycle, especially since corporate profits are in decline.

Latest US business cycle that has been expanding, has now continued growth for 78 months, much higher than 45 months average of last 115 years.

However, what giving us hope, business cycles' expansionary leg has increased in average since 1970, averaging around 71 and last three business cycle averaged about 95 months, in thanks to 120 months long expansion before dot com bubble burst.

Nevertheless it is vital to recognize, we are slowly closing into rarest of the stretch (check figure).

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out