Federal Reserve Chair Janet Yellen joined the band of investors like Carl Icahn, Warren Buffet as last night she warned against complacency in stock market saying that valuations in stock market remains on higher side and pose significant risk of falling to the downside. However according to her overall risks to financial stability remains stable and contained.

Ms. Yellen has also warned against sharp bond market movement especially on the longer end of the curve, when Federal Reserve would start hiking rates.

Bond market impact -

- Fed rate hike might give rise to term premium which might shoot up rapidly posing significant risks to investors shorting longer dated bond. Moreover recent rise in global bond yields indicate that investors are growing anxious over holding longer dated government securities as they fear of inflation in coming time.

Stock market impact -

- Equity market is long due a major correction so any significant sell off does not mean that good old bullish days are over for equities as return of global growth would be price supportive of equities.

- Clear 10-20% correction in the index might be sweet spot to buy.

Volatility -

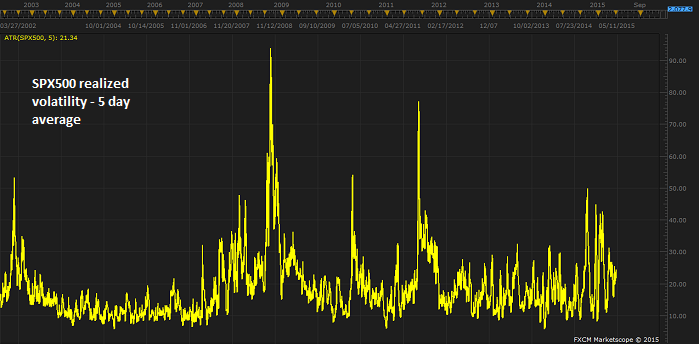

Chart is attached that shows 5 day average of realized volatility in SPX500 index.

- Realized daily volatility remains low, around 1%, however volatility clustering is warning against volatile days ahead.

S&P500 is trading close to 2077, key support lies at 2040 level.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary