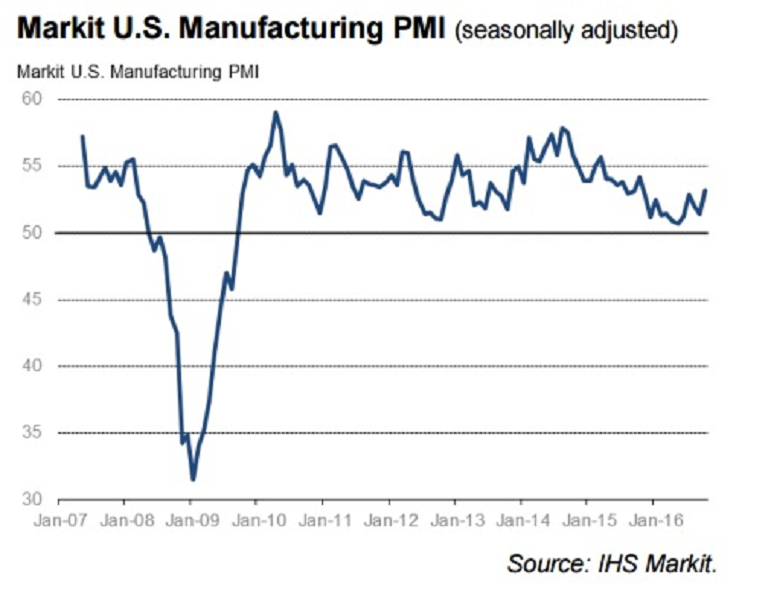

Manufacturing conditions in the United States witnessed a strong improvement during the month of October, buoyed by a sharp rise in output as well as new orders. Also, higher demand helped lift the country’s manufacturing index.

The U.S. Manufacturing Purchasing Managers’ Index (PMI) Index rose to 53.2 from 51.5 the month prior and was above the 51.5 forecast that analysts had anticipated in a Reuters poll. Further, the increase in purchase activity was at the fastest pace since June of last year, data released by compiler IHS Markit showed Monday.

"Manufacturing showed further signs of pulling out of the malaise seen earlier in the year, starting the fourth quarter on a solid footing. Both output and new orders are rising at the fastest rates for a year amid increasingly widespread optimism that demand will pick up again after the presidential election, which has been commonly cited as a key factor that has subdued spending and investment in recent months," said Chris Williamson, Chief Business Economist, Markit.

Meanwhile, the Chicago Fed National Activity index also showed improvement rising from a revised -0.72 in August to -0.14 in September. Of the 85 monthly individual indicators, 41 made positive contributions and 44 deteriorated. Results below zero indicate below trend growth.

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient